A definitive guide for companies navigating China's dynamic e-commerce talent landscape

Executive Summary

Dive into the world's most formidable digital marketplace: China's e-commerce sector. This report deciphers the immense opportunities and significant complexities facing international companies, offering a comprehensive analysis of current and future e-commerce jobs, careers, and salaries.[1], [2]

The market's expansion, while maturing from its historical peaks, continues unabated, fueled by remarkable digital adoption, sophisticated payment infrastructures, and groundbreaking models like social and live-streaming commerce.[3] Dynamic segments such as live commerce, cross-border e-commerce (CBEC), and B2B e-commerce are exhibiting particularly robust growth.[4]

The competitive arena is dominated by established titans like Alibaba and JD.com, yet constantly challenged by disruptive forces such as Pinduoduo and the meteoric rise of social/live commerce platforms like Douyin and Kuaishou.[5] This fierce competition plays out against an evolving regulatory backdrop, featuring heightened scrutiny on anti-monopoly practices and data privacy under the Personal Information Protection Law (PIPL).[6] Successfully navigating this landscape demands deep local expertise and strategic agility.[7]

Talent remains the cornerstone of success. There's persistent high demand for professionals skilled in digital marketing, platform operations (especially for Tmall, JD, Douyin), data analytics, AI and machine learning, cross-border operations, and live-stream management.[8] Salaries are competitive but vary significantly based on experience, location (with Tier 1 cities and Hangzhou commanding premiums), company type (MNCs often paying more), and specialized skills.[9] While overall salary increases might moderate with economic shifts, the intense competition for niche talent is driving substantial pay increments for those in high-demand roles.[10]

Looking ahead, the future of e-commerce work in China will be profoundly shaped by:

- Deepening AI integration

- The potential emergence of immersive metaverse experiences

- The continued evolution of social and live commerce

- Ongoing automation impacting roles in logistics and beyond

- A growing emphasis on sustainability[11]

For professionals, continuous learning, adaptability, and the development of hybrid skillsets (combining technical depth with strong soft skills) are not just beneficial, but imperative.[12] For international companies, strategic success hinges on developing localized expertise, adopting multi-platform and omnichannel strategies, investing heavily in technology and compliance, and implementing robust, market-tailored talent acquisition, development, and retention programs.[13] Ultimately, thriving in China's e-commerce sector depends on adeptly navigating the intricate interplay of market dynamics, technological innovation, regulatory constraints, and human capital.[14]

Hiring in China?

Post open roles across China’s top job sites, classifieds, and networking platforms — lower hiring costs by over 80%.

Table of Contents

ToggleIntroduction

China's e-commerce sector is more than just a market; it's a global phenomenon that dictates trends and influences digital commerce worldwide, accounting for nearly half of all global e-commerce transactions.[15] Its immense scale is paralleled only by its dynamism, characterized by lightning-fast innovation cycles, a deeply embedded mobile-first consumer culture, and the constant emergence of novel business models that seamlessly blend shopping with entertainment and social interaction.[3], [15]

This report serves as a definitive guide for international companies striving to understand and navigate the multifaceted e-commerce talent market in China. It delves into the critical aspects of jobs, career pathways, salary benchmarks, essential skills, and the future trends shaping this vibrant sector.[16], [17] The goal is to arm business leaders and HR professionals with the actionable intelligence required to build triumphant teams and operations in this unique ecosystem.

The Chinese e-commerce landscape is distinguished by several unique traits. Innovations such as:

- AI-driven hyper-personalization

- The meteoric ascent of live-streaming commerce

- The profound integration of social commerce

- The development of "New Retail" models merging online and offline experiences

These are not distant concepts but present-day realities.[3], [18] Platform competition is exceptionally fierce, involving established giants, disruptive challengers, and specialized niche players.[5] Furthermore, the sector operates within a complex and actively evolving regulatory framework, particularly concerning anti-monopoly enforcement and data privacy, adding yet another layer of complexity.[7], [18] Grasping these nuances is paramount for any organization aiming to compete effectively.

1. China’s E-commerce Market Landscape: Scale, Segments, and Platforms

1.1. Unprecedented Market Scale and Growth Dynamics

China's undisputed global leadership in e-commerce remains secure, a result of its vast population, high digital penetration, and advanced infrastructure.[1], [19] The market's sheer size is staggering. In 2024, online retail sales (primarily physical goods sold via internet platforms) soared to 15.23 trillion yuan (approximately $2.14 trillion USD), marking a 7.2% year-on-year increase.[20] While estimates for the total market size vary due to differing methodologies (e.g., IBISWorld's $2.8 trillion "Online Shopping" industry revenue for 2024[21] vs. Mordor Intelligence's $1.57 trillion projection for 2025[22]), the upward trajectory is clear.

Although headline growth rates might seem moderate compared to previous explosive expansions (e.g., China's projected retail e-commerce CAGR of 9.97% for 2024-2028[15]), the absolute growth in monetary terms remains immense. A projected 10.07% CAGR between 2025 and 2030 is anticipated to add nearly a trillion dollars to the market, reaching an estimated $2.54 trillion.[22] Crucially, this aggregate view masks the hyper-growth within specific segments. For instance, live commerce revenue is forecast to grow at an astonishing 32.8% CAGR between 2025 and 2030,[23] and B2B e-commerce is also set for significant expansion.[22] E-commerce forms a substantial and growing part of China's total retail landscape, with online retail penetration potentially exceeding one-third of total retail value, far surpassing the global average.[24], [25]

Key drivers underpinning this colossal market include:

- Digital Penetration: Over 1.09 billion internet users (around 77.5% of the population) as of late 2023 create a massive addressable market.[21], [26] Ubiquitous smartphone ownership is a key enabler of mobile commerce.[4]

- Rising Affluence: A large and expanding middle class, exceeding 700 million consumers, possesses increasing disposable income and a strong appetite for online shopping.[27], [26]

- Sophisticated Digital Payments: Systems like Alipay and WeChat Pay are dominant, utilized by approximately 90% of online payment users. Mobile payments are the norm for an overwhelming 88% of consumers, deeply integrated into daily life.[28], [26]

- Government Support: Initiatives under the "Digital China" strategy, policies favoring cross-border trade, and a national emphasis on innovation actively foster e-commerce development.[2], [29]

- Evolving Consumer Behavior: Chinese consumers increasingly demand personalized experiences, ultimate convenience, entertainment value ("shoppertainment"), and social validation through online channels.[3], [29]

China E-commerce: Projected Segment Growth (CAGR)

1.2. Diverse Market Segments

China's e-commerce market is not a monolith but a vibrant tapestry of distinct and increasingly interconnected segments:[30]

- B2C (Business-to-Consumer): This remains the dominant retail segment, spearheaded by platforms like Alibaba's Tmall and JD.com. These platforms emphasize branded goods, product authenticity, quality assurance, and often boast sophisticated logistics.[1], [19] B2C also commands the largest share of cross-border e-commerce transactions, accounting for over 71%.[31]

- C2C (Consumer-to-Consumer): Pioneered by Alibaba's Taobao, this segment allows individuals and small businesses to sell directly. It's rapidly evolving with the integration of social and live-streaming features.[5], [32]

- Social Commerce: A defining feature, integrating shopping directly within social media. It accounted for a staggering 46.6% of all e-commerce sales in China in 2023.[33], [34] The market was valued at approximately $497 billion in 2024 and is projected to grow at a CAGR of 7.4% (2025-2030), reaching $769 billion.[35] Key players include Douyin, Kuaishou, Xiaohongshu (Little Red Book), and WeChat.[5] Douyin alone reportedly generated $200 billion in GMV from social commerce in 2024.[33]

- Live-Streaming Commerce: A sub-segment of social commerce that has exploded in popularity, combining real-time video with direct purchasing. This segment hit an estimated 5.8 trillion yuan (~$803 billion USD) in revenue in 2023[36] and accounted for roughly 31.9% of China's total e-commerce GMV.[24] Market revenue projections suggest growth to $24 billion by 2030, reflecting a robust 32.8% CAGR from 2025.[23] Taobao Live, Douyin, and Kuaishou are at the forefront.[1] An estimated 765 million people in China (71% of internet users) engaged with live commerce by mid-2023.[24], [37]

- Cross-Border E-commerce (CBEC): A crucial channel for international brands. China's total CBEC trade (imports and exports) reached $273 billion in 2021.[1], [38] The domestic market for imported goods via CBEC was valued at $396.9 billion in 2024, with a projected CAGR of 19.8%.[31] The associated logistics market is also substantial, estimated at $58.6 billion in 2025 and expected to reach $86.7 billion by 2030 (8.3% CAGR).[25] Platforms like Tmall Global, JD Worldwide, and Kaola specialize in these transactions.[1]

- B2B E-commerce: Anticipated to experience strong growth, fueled by the digitalization of Chinese businesses, particularly SMEs.[22], [39] The Asia-Pacific B2B market, projected to hold 80% of the global share by 2026, underscores this segment's significance.[15]

- New Retail / O2O (Online-to-Offline): This model seeks to erase boundaries between digital and physical shopping, pioneered by Alibaba's Hema Fresh and JD.com's 7-Fresh.[4], [40] These stores extensively use digital technologies and often function as hyperlocal fulfillment centers offering rapid delivery.[40], [41]

The market's dynamism arises significantly from the interplay between these segments. Effective e-commerce strategies in China must recognize and leverage these interconnections, demanding talent capable of navigating omnichannel complexity.[35], [40], [22], [42]

Key E-commerce Adoption & Activity Metrics in China (%)

1.3. Dominant Platforms and Competitive Dynamics

The platform landscape is highly concentrated yet fiercely competitive:[43]

- Incumbents: Alibaba Group (with Taobao and Tmall) and JD.com have historically dominated.[1] Alibaba's vast ecosystem encompasses commerce, logistics (Cainiao), cloud services, and media.[19] JD.com is renowned for its B2C focus, strong stance on product authenticity, and extensive self-operated logistics.[5] Historical estimates placed Alibaba around 50-60% market share and JD around 16-20%.[1]

- Challengers: Pinduoduo (PDD) emerged as a major force by focusing on group-buying, interactive features, and targeting price-sensitive consumers.[1], [44] More recently, platforms deeply integrated with short video and social media – primarily Douyin and Kuaishou – have surged in importance, leveraging massive user bases for e-commerce sales, particularly through live streaming.[5] Additionally, platforms like Temu (operated by PDD) and Shein have achieved significant global traction.[35]

- Niche Players: Beyond the giants, specialized platforms cater to specific needs. Xiaohongshu (Little Red Book) thrives on user-generated content, particularly in beauty and fashion.[1] Vipshop focuses on flash sales.[45] Suning is a major player in electronics,[46] and Dewu has carved a niche in authenticated sneakers and trendy apparel.[5]

This diverse ecosystem necessitates strategic platform choices based on business model, product categories, and target demographics.[47] Tmall caters to established brands,[48] while JD.com appeals to consumers prioritizing authenticity and fast delivery. Pinduoduo attracts value-conscious shoppers. Douyin leverages entertainment for impulse purchases, and Xiaohongshu serves as a discovery platform driven by community trust.[5]

Competitive intensity is further amplified by regulatory dynamics. The State Administration for Market Regulation (SAMR) has significantly increased scrutiny of anti-competitive practices since late 2020, targeting practices like "forced exclusivity."[6], [9] Government industrial policy also aims to bolster domestic platforms globally.[29] This confluence creates a fluid environment demanding agility and robust compliance strategies.[49], [50]

Table 1: China E-commerce Market Segments - Size & Growth (Est. 2024/2025)

| Segment Name | Estimated Market Size/GMV (USD/CNY) (Year) | Estimated Growth Rate (YoY or CAGR) | Key Platforms | Notes |

|---|---|---|---|---|

| Overall E-commerce | $1.57 Trillion (USD) (2025 Est.) | 10.07% CAGR (2025-2030) | Alibaba, JD, PDD, Douyin, etc. | Mordor Intelligence Estimate; definitions vary.[22] |

| Online Retail Sales | ¥15.23 Trillion / ~$2.14 Trillion (USD) (2024) | 7.2% YoY (2024) | Tmall, JD, PDD, Taobao, etc. | NBS Data; primarily physical goods.[20] |

| Social Commerce | $537.29 Billion (USD) (2025 Est.) | 8.0% YoY (2025); 7.4% CAGR (2025-30) | Douyin, Xiaohongshu, WeChat, Kuaishou | Rapidly growing integration.[35] |

| Live-Streaming Commerce | ~$803 Billion (USD) (2023 Revenue) | 32.8% CAGR (2025-2030 Revenue) | Taobao Live, Douyin, Kuaishou | Explosive growth; revenue vs. GMV differs.[23] |

| Cross-Border E-commerce | $396.9 Billion (USD) (2024 Market Value) | 19.8% CAGR | Tmall Global, JD Worldwide, Kaola | China market value; logistics also growing.[31], [25] |

| B2B E-commerce | N/A (Specific Value) | Expected High Growth | Alibaba.com, DHGate, Made-in-China | Driven by SME digitalization.[22] |

| New Retail / O2O | N/A (Segment Value) | Trend-driven | Hema (Alibaba), 7-Fresh (JD) | Integrating online/offline; value in platforms.[40] |

Note: Market size figures can vary significantly based on definition and source methodology. Growth rates also vary. This table provides indicative values.[51]

Table 2: Key E-commerce Platforms in China: Focus & Target Audience

| Platform Name (Group) | Primary Model(s) | Key Product Categories | Target Audience/Demographics | Key Strengths/Features |

|---|---|---|---|---|

| Tmall (Alibaba) | B2C | Branded Goods (All Categories), Premium | Quality-conscious consumers, Brand followers | Brand flagship stores, Quality assurance, Large user base, Alibaba ecosystem integration[1] |

| Taobao (Alibaba) | C2C, Live Commerce | Wide Variety (Fashion, Lifestyle, etc.) | Broad consumer base, Price-sensitive shoppers, Niche interests | Huge selection, Live streaming, Community interaction, Low barrier for sellers[1] |

| JD.com | B2C, Live Commerce, New Retail (7Fresh) | Electronics, Appliances, Groceries, Luxury | Quality/Authenticity focused, Tech-savvy, Higher-tier cities | Self-operated logistics, Authenticity guarantee, Strong in 3C products[1] |

| Pinduoduo (PDD) | Social Commerce (Group Buying), B2C | Value Goods, Groceries, Agriculture | Price-sensitive consumers, Lower-tier cities, Mobile-first users | Group buying discounts, Interactive features, Focus on value[1] |

| Douyin (ByteDance) | Social Commerce, Live Commerce | Fashion, Beauty, FMCG, Impulse buys | Younger users (Gen Z/Millennials), Urban population, Trend followers | Short video integration, Powerful algorithm, High engagement, Live streaming dominance[5] |

| Kuaishou | Social Commerce, Live Commerce | Similar to Douyin, broader reach in lower tiers | Wider demographic reach, Lower-tier cities | Strong live streaming, Community focus[1] |

| Xiaohongshu (RED) | Social Commerce, Content Commerce | Beauty, Fashion, Lifestyle, Travel | Young urban females, Affluent consumers seeking recommendations | Content-driven discovery, User reviews, Community trust[1] |

| WeChat (Tencent) | Social Commerce (Mini Programs) | Various (via embedded stores/programs) | Entire WeChat user base | Seamless integration, Mini Programs, Social payments[5] |

| Tmall Global / JD Worldwide | Cross-Border B2C | International Brands (All Categories) | Chinese consumers seeking imported goods | Official channels for foreign brands, Logistics solutions, Access to vast user bases[1] |

| Temu / Shein | B2C (Often Cross-Border) | Fast Fashion, Affordable Goods | Price-sensitive global consumers (initially) | Aggressive pricing, Vast selection, Mobile-first, Strong supply chain[35] |

2. Key Trends Shaping China’s E-commerce Landscape

The Chinese e-commerce market is in a state of perpetual evolution, with several pivotal trends currently reshaping its contours and influencing strategies, consumer behaviors, and talent demands.

- Social and Live Commerce Convergence: The fusion of social interaction and online shopping is arguably the most defining trend.[35], [52] Platforms are now deeply integrated social ecosystems. Live-streaming has transitioned from novelty to a mainstream sales channel, driving significant GMV through "shoppertainment."[3], [24] This is particularly effective for categories like fashion and beauty.[35], [45]

- AI-Powered Personalization and Operations: Artificial intelligence and big data analytics are pervasive, optimizing everything from hyper-personalized user feeds and dynamic pricing to targeted advertising.[3], [53] AI also streamlines operations, including customer service chatbots, logistics, and inventory management.[3], [54] Effective AI leverage is now a fundamental requirement.[3], [8], [9]

- Rise of "New Retail" and Omni-Channel Integration: The "New Retail" concept signifies the deep integration of online and offline commerce.[4] Physical stores are transforming into multi-functional spaces—brand experience centers, community hubs, and hyperlocal fulfillment centers offering rapid delivery.[40], [41]

- Cross-Border E-commerce Expansion: CBEC remains a significant growth engine, fueled by strong consumer appetite for international brands and supportive government policies.[1], [31] Simultaneously, Chinese e-commerce players like Shein and Temu are aggressively expanding globally.[35], [55]

- The "Sinking Market" and Lower-Tier City Focus: Vast growth potential lies in China's lower-tier cities and rural areas (the "sinking market"). Platforms like Pinduoduo capitalized on this, and incumbents are increasingly focusing efforts here.[5], [22], [39]

- Evolving Regulatory Landscape: The regulatory environment is complex and actively enforced. Since late 2020, authorities have intensified efforts to curb anti-competitive practices.[6], [7] The Personal Information Protection Law (PIPL) imposes strict data privacy requirements.[9] New regulations also target unfair online competition.[7] Compliance is now a core strategic consideration.[3], [29], [49]

3. In-Demand E-commerce Roles and Career Paths in China

The scale and complexity of China's e-commerce market necessitate a diverse and highly skilled workforce. Talent acquisition and development are critical differentiators.[16] Core e-commerce functions include: Operations, Marketing, Sales & Business Development, Technology, Customer Service, and Product Management & Sourcing.[3], [16]

3.1. High-Demand Roles:

- E-commerce Manager/Director: Oversees entire e-commerce strategy, P&L, teams, and key platform partner relations.[16], [17]

- Digital Marketing Manager/Specialist: Professionals adept at China's unique digital marketing landscape (platform-specific ads, Baidu SEO, social media engagement, KOL campaigns).[16], [56] Marketing Manager/Director is among the top 10 most in-demand jobs in China for 2025.[57]

- Operations Manager: Crucial for managing logistics, warehousing, supply chain efficiency, inventory control, and fulfillment.[16]

- Data Analyst / Business Analyst (E-commerce Focus): Extracts actionable insights from data related to sales, customer behavior, and marketing effectiveness.[16], [44]

- Platform Operations Specialist: Requires deep, practical knowledge of specific major platforms like Tmall, JD.com, Pinduoduo, or Douyin.[5], [16]

- Cross-Border E-commerce Specialist/Manager: Manages complexities of international sales, including logistics, customs, platform operations, and marketing adaptation.[25], [38], [48]

- Live Stream Host / KOL Manager: Charismatic hosts for real-time sales; managers to identify and manage influencer relationships and campaigns.[24], [36]

- AI/Machine Learning Engineer: Develops and maintains AI algorithms for personalization, recommendation systems, chatbots, and operational automation. A significant talent gap exists.[3], [8]

- Product Manager (E-commerce): Focuses on optimizing digital products (website/app) or managing physical product lifecycles.[16]

- Customer Service Representative/Manager: Handles complex issues and oversees service quality, integrating human and AI support.[3]

3.2. Career Path Progression:

Career trajectories typically advance from foundational roles to specialized or managerial positions:[16]

- Entry-Level: Roles like E-commerce Coordinator, Digital Marketing Assistant, Operations Clerk. Focus on learning core processes.[16]

- Mid-Level: Positions such as E-commerce Specialist, SEO/SEM Specialist, Social Media Manager, Data Analyst. Involves deepening technical expertise.[16]

- Senior/Management Level: E-commerce Manager, Digital Marketing Manager, Head of E-commerce. Includes strategic planning and leadership.[16], [17]

- Specialization Tracks: Deep expertise in areas like CBEC strategy, Live Streaming management, Data Science/AI applications.[3], [10]

A "career lattice" approach, involving lateral moves for broader experience, is increasingly beneficial.[58], [59] Continuous learning and adaptability are paramount in this rapidly evolving market.[3], [11], [12] Employers increasingly prioritize learning agility.[59] Formal education, like an MBA with a China focus, can further accelerate career development.[2], [60]

Table 3: In-Demand E-commerce Roles & Average Annual Salary Ranges (CNY/USD) by Experience Level (Illustrative)

| Job Title | Primary Responsibilities (Brief) | Experience Level | Average Annual Salary Range (CNY) | Average Annual Salary Range (USD)* | Key Skills Required |

|---|---|---|---|---|---|

| E-commerce Manager | Oversee strategy, P&L, team management, platform relations | Junior (1-3 yrs) | ¥225,000 - ¥300,000 | $31,800 - $42,500 | E-com Strategy, Digital Marketing, Leadership, P&L Management, Platform Knowledge[61] |

| Mid (3-7 yrs) | ¥300,000 - ¥450,000 | $42,500 - $63,700 | |||

| Senior (8+ yrs) | ¥450,000 - ¥675,000+ | $63,700 - $95,500+ | |||

| IT E-commerce Marketing Manager (Shenzhen Specific) | Manage online marketing strategy, campaigns, technology integration for e-commerce | Entry (1-3 yrs) | ~¥221,000 | ~$31,300 | Digital Marketing (SEO/SEM/Social), E-com Platforms, Analytics, MarTech[62] |

| Senior (8+ yrs) | ~¥511,000 | ~$72,400 | |||

| E-commerce Specialist (Shenzhen Specific) | Execute platform operations, manage listings, run campaigns, analyze performance | Entry (1-3 yrs) | ~¥200,000 | ~$28,300 | Platform Ops (Tmall/JD/etc.), Digital Marketing Tools, Analytics, Excel[63] |

| Senior (8+ yrs) | ~¥353,000 | ~$50,000 | |||

| E-commerce Business Analyst (Nanjing Specific) | Analyze sales, customer, marketing data; provide insights for decision-making | Entry (1-3 yrs) | ~¥223,000 | ~$31,600 | Data Analysis, SQL, Excel, Analytics Platforms (GA/Baidu), Visualization, Business Acumen[44] |

| Senior (8+ yrs) | ~¥392,000 | ~$55,500 | |||

| Business Analyst (General Tech) | Requirements gathering, process analysis, system analysis | 25th Percentile | ¥311,000 | $44,000 | Analytical Skills, Problem Solving, Communication, Requirements Elicitation, SQL/Data Modeling[64] |

| 50th Percentile | ¥406,000 | $57,500 | |||

| 75th Percentile | ¥613,000 | $86,800 | |||

| Live Stream Host | Promote products via live broadcasts, engage audience, drive sales | Varies | ¥10,000+/month base + Commission | $1,400+/month base + Commission | Communication, Charisma, Sales Skills, Product Knowledge, Platform Familiarity[65] |

| Cross-Border E-com Specialist | Manage international logistics, customs, platform ops, int'l marketing | Mid-Senior | ¥250,000 - ¥450,000+ | $35,400 - $63,700+ | CBEC Platforms, Int'l Logistics, Customs Regs, Digital Marketing, English/Mandarin[48] |

| AI/Machine Learning Engineer | Develop/implement AI for personalization, recommendations, chatbots, operations optimization | Mid-Senior | ¥500,000 - ¥1,000,000+ | $70,800 - $141,500+ | Python/R, ML Frameworks, Data Science, Algorithms, Big Data Tech[8] |

| Operations Manager (E-commerce) | Manage logistics, warehousing, fulfillment, supply chain, inventory | Mid-Senior | ¥400,000 - ¥700,000+ | $56,600 - $99,000+ | Logistics Management, Supply Chain Optimization, WMS/TMS, Vendor Management[16] |

Illustrative Senior E-commerce Salaries in China (Annual, CNY)

*USD figures approximate (1 USD = 7.06 CNY, June 2025), subject to fluctuation. Salary ranges are indicative and can vary significantly based on specific company, exact location within China, candidate qualifications, industry sector, and negotiation. Data from Paylab for E-commerce Specialist showed significantly lower figures and is used cautiously.[51], [66]

4. E-commerce Salaries in China: Benchmarks and Influencing Factors

Compensation is a critical element in attracting and retaining talent within China's competitive e-commerce sector.[16] While salaries are generally attractive, numerous factors influence pay levels.

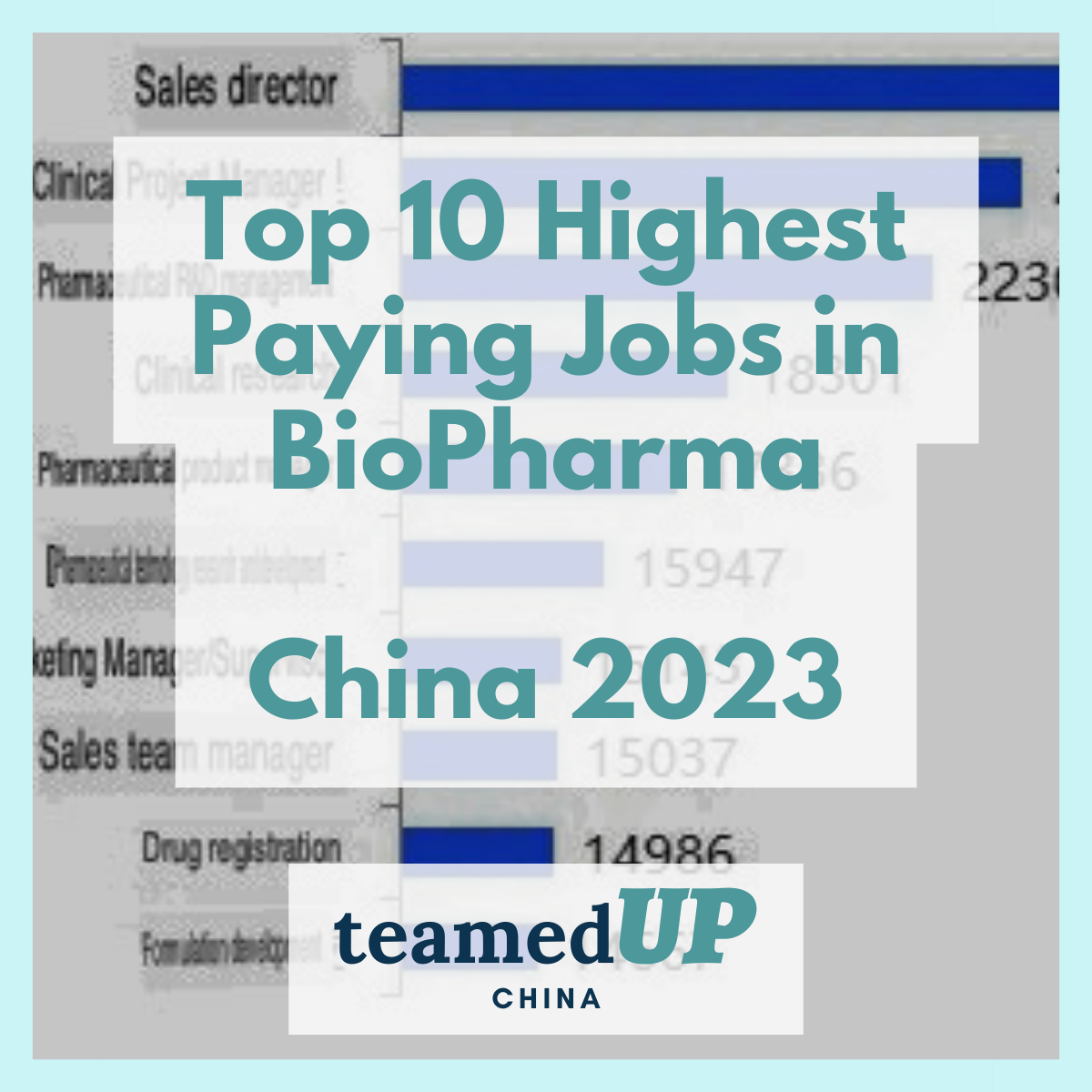

Benchmark data reveals substantial earning potential:

- An E-commerce Manager commands an average annual salary estimated around $53,075 USD (approximately ¥380,000 CNY), with senior-level managers potentially earning upwards of $95,535 USD (around ¥675,000 CNY) or more.[61]

- Specialized managerial roles, such as an IT E-commerce Marketing Manager in a major hub like Shenzhen, show average salaries around ¥395,685 CNY, with senior levels reaching over ¥510,000 CNY.[62]

- Mid-level roles like E-commerce Specialist in Shenzhen average around ¥281,622 CNY, with senior specialists exceeding ¥350,000 CNY.[63] (Note: Some sources like Paylab report much lower ranges.[51])

- Analytical roles such as E-commerce Business Analyst in Nanjing average around ¥313,005 CNY, with senior analysts surpassing ¥390,000 CNY.[44] Broader Business Analyst roles within the technology sector show a median salary of ¥406,000 CNY, reaching ¥613,000 CNY at the 75th percentile.[64]

- Live Stream Hosts present a unique compensation structure. While base salaries might be modest (e.g., starting above ¥10,000/month), significant income is generated through sales commissions. Top-tier hosts can earn millions annually.[65], [67]

4.1. Factors Influencing Salaries:

- Experience Level: A primary driver of salary increases across virtually all roles.[61]

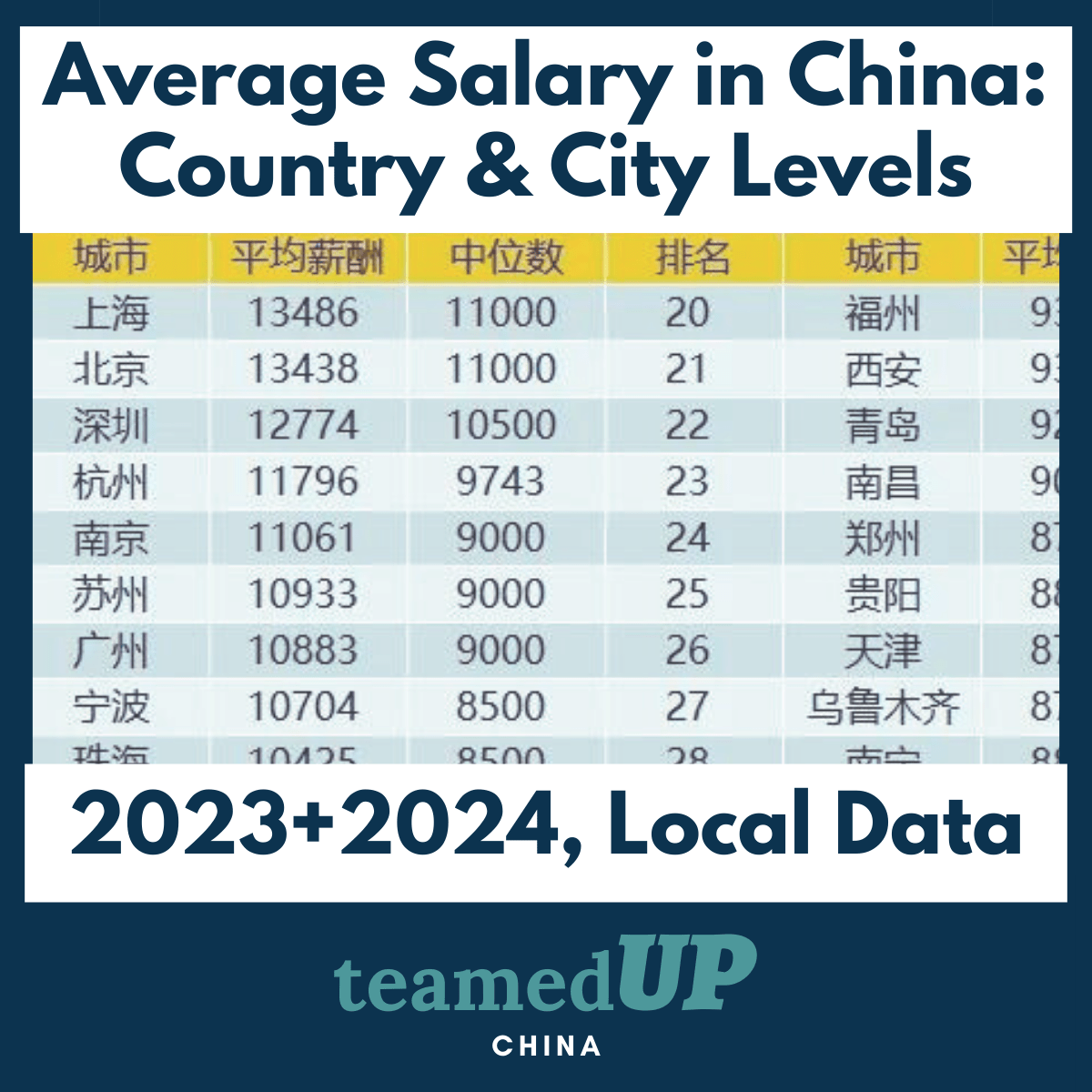

- Location: Tier 1 cities (Shanghai, Beijing, Shenzhen, Guangzhou) and the e-commerce hub of Hangzhou consistently exhibit higher salary levels.[39], [44]

- Company Type & Size: Multinational Corporations (MNCs) often offer higher compensation.[13] Large domestic tech giants also provide competitive packages. Startups might include equity.[32]

- Industry/Sector Focus: Salaries can differ based on the specific industry vertical (e.g., luxury goods, FMCG, electronics).[64]

- Specialization & Skills: Niche skills in high-demand areas like AI/ML, advanced data science, cross-border e-commerce expertise, and specific platform algorithms command premiums.[8]

- Performance & Impact: Particularly in sales-driven roles, a substantial portion of compensation is often variable (commissions, bonuses).[59], [67]

4.2. Salary Trends and Forecasts (2025 onwards):

The outlook is nuanced. Macroeconomic factors may exert downward pressure on overall salary increases, with average increments potentially hovering around 5% for 2025.[39]

However, this average masks significant variations. The intense competition for specific talent pools creates a different reality. Demand for skilled e-commerce personnel remains robust (e.g., E-commerce Manager roles reportedly seeing 15% annual market growth[61]). Persistent talent shortages mean companies often pay significant premiums.[8], [10] Job seekers with in-demand skills can often command salary increments from 5% to as high as 20%.[59]

This points towards a bifurcated salary market: while the overall economic climate may temper average raises, the "war for talent" in critical e-commerce specializations will likely sustain premium salaries. Effective compensation strategies will require granular benchmarking and attractive non-financial benefits.[14], [59]

5. Essential Skills for E-commerce Professionals in China

Success in China's fast-paced e-commerce sector demands a sophisticated blend of technical proficiency, sharp business acumen, and crucial soft skills.[14]

5.1. Technical Skills:

- Platform Proficiency: Deep understanding of major platforms' backend operations, advertising systems (e.g., Alimama, JD Jingzhuntong, Douyin Ocean Engine), promotional tools, and platform-specific rules.[5] WeChat Mini Program knowledge is also key.[5]

- Digital Marketing Tools: Proficiency in SEO/SEM tools adapted for China (Baidu), social media management platforms (WeChat, Weibo, Douyin, Xiaohongshu), CRM systems.[16], [56]

- Data Analysis & Visualization: Ability to use web/app analytics tools, advanced Excel, SQL, and potentially Python or R. Data visualization tools like Tableau or Power BI are also important.[16], [41]

- AI & Machine Learning Literacy: A foundational understanding of AI is becoming necessary across many roles. For technical roles, deep expertise in ML algorithms and AI development frameworks is crucial.[3], [8]

- Web Development Fundamentals: Basic knowledge of HTML, CSS, and JavaScript can be advantageous.[41]

- Logistics & Supply Chain Software: Familiarity with WMS, TMS, and ERP systems.[16]

- Cybersecurity & Data Privacy Awareness: Understanding of fundamental cybersecurity principles and, critically, China's PIPL requirements.[9]

5.2. Soft Skills:

- Communication: Clear and effective communication is paramount. Cross-cultural communication skills are particularly important.[41], [48]

- Problem-Solving: Ability to identify issues, analyze root causes, and develop practical, data-driven solutions.[41]

- Adaptability & Learning Agility: Professionals must be highly adaptable and possess a strong willingness to continuously learn.[3], [11]

- Analytical & Strategic Thinking: Ability to interpret trends, understand the competitive landscape, and formulate effective long-term strategies.[41]

- Project Management: Skills to organize tasks, manage timelines and resources. Familiarity with Agile methodologies is beneficial.[41]

- Customer Centricity: A deep focus on understanding customer needs and preferences.[61]

- Commercial Acumen: Understanding business models, key financial metrics, and market dynamics.[16]

- Collaboration & Teamwork: E-commerce success relies on seamless collaboration between different functions.[41]

5.3. Language Skills:

- Mandarin Chinese: Proficiency is generally essential for most roles operating within the domestic Chinese market.[60]

- English: Business proficiency is often a requirement for roles within MNCs and those focused on cross-border e-commerce.[48]

The most valuable e-commerce professionals in China today possess a hybrid skillset, combining deep technical or digital expertise with strong commercial understanding and critical soft skills.[8] Developing "T-shaped professionals" should be a key focus for talent development.

Table 4: Essential Skills for China E-commerce Professionals (Technical & Soft)

| Skill Category | Specific Skill | Importance Level | Relevant Roles |

|---|---|---|---|

| Platform Proficiency | Tmall/Taobao Operations & Advertising | Advanced | E-com Manager, Platform Specialist, Marketing Specialist[5] |

| JD.com Operations & Advertising | Advanced | E-com Manager, Platform Specialist, Marketing Specialist[5] | |

| Pinduoduo Operations & Strategy | Advanced | E-com Manager, Platform Specialist, Marketing Specialist[5] | |

| Douyin/Kuaishou E-commerce & Live Streaming | Advanced | E-com Manager, Social/Live Specialist, Marketing Manager, Host[5] | |

| WeChat Mini Program Development/Operation | Advanced | E-com Manager, Marketing Specialist, Developer[5] | |

| Xiaohongshu Content & Community Strategy | Advanced | Social Media Manager, Content Specialist, Marketing Manager[5] | |

| Digital Marketing | SEO (Baidu focus) / SEM (PPC) | Advanced | Marketing Specialist/Manager, SEO/SEM Specialist[16] |

| Social Media Marketing (WeChat, Weibo, Douyin, etc.) | Advanced | Marketing Specialist/Manager, Social Media Manager[16] | |

| KOL / Influencer Marketing Management | Advanced | Marketing Manager, KOL Manager, Social Media Manager[45] | |

| Content Marketing & Creation | Advanced | Marketing Specialist, Content Manager/Creator[16] | |

| CRM & Customer Lifecycle Management | Advanced | Marketing Manager, CRM Specialist, Data Analyst[41] | |

| Data Analysis | E-commerce Analytics Platforms (GA, Baidu Tongji, Platform Native) | Advanced | Data Analyst, Business Analyst, Marketing Analyst, E-com Manager[16] |

| SQL for Data Querying | Advanced | Data Analyst, Business Analyst, Data Engineer[41] | |

| Advanced Excel / Spreadsheet Skills | Foundational | Most Roles (Analyst, Specialist, Manager)[41] | |

| Data Visualization (Tableau, Power BI, etc.) | Advanced | Data Analyst, Business Analyst[41] | |

| Statistical Analysis / Modeling (Python/R optional) | Advanced | Data Scientist, Senior Data Analyst[41] | |

| AI / Tech | AI/ML Concepts & Applications Literacy | Emerging | Most Roles (Increasingly)[3] |

| AI Development (Python, ML Frameworks) | Advanced | AI/ML Engineer, Data Scientist[8] | |

| Web Development Basics (HTML, CSS, JS) | Foundational | Web Manager, E-com Specialist (some roles)[41] | |

| Cybersecurity & PIPL Compliance Awareness | Foundational | All Roles handling data[9] | |

| Operations & CBEC | Logistics & Supply Chain Management | Advanced | Operations Manager, Supply Chain Specialist[16] |

| Warehouse Management Systems (WMS) / TMS / ERP | Advanced | Operations Manager/Specialist[16] | |

| Cross-Border E-commerce Platforms & Processes | Advanced | CBEC Manager/Specialist[26] | |

| International Logistics & Customs Regulations | Advanced | CBEC Manager/Specialist, Operations Manager[25] | |

| Soft Skills | Communication (Verbal, Written, Cross-Cultural) | Foundational | All Roles[41] |

| Adaptability & Learning Agility | Foundational | All Roles[11] | |

| Problem-Solving & Critical Thinking | Foundational | All Roles[41] | |

| Analytical & Strategic Thinking | Advanced | Analyst Roles, Manager Roles, Strategy Roles[41] | |

| Project Management / Agile Methodologies | Advanced | Manager Roles, Specialist Roles, Tech Roles[41] | |

| Collaboration & Teamwork | Foundational | All Roles[41] | |

| Customer Centricity | Foundational | Customer-facing Roles, Marketing, Product Roles[61] | |

| Commercial Acumen / Business Understanding | Advanced | Manager Roles, Strategy Roles, Business Development[16] | |

| Language | Mandarin Chinese (Business Proficiency) | Foundational | Most roles operating in China[60] |

| English (Business Proficiency) | Advanced | Roles in MNCs, Cross-Border Roles, Roles requiring global interaction[48] |

Importance Level: Foundational (Essential for most roles), Advanced (Required for specialized/senior roles), Emerging (Increasingly important for future success).

Hiring in China?

We can help, and likely lower your hiring costs by over 80%

Our China Candidate Sourcing Service helps companies post & promote open roles across top Chinese jobs & networking platforms.

Let’s find your next great China-based team member together.

Contact us to discuss hiring goals, salary & compensation budgets, and if TeamedUp China is the right fit to support your organization.

New here? Get 25% off your first job post with us.

Our Related Articles

References

- China - eCommerce - International Trade Administration, accessed May 13, 2025, https://www.trade.gov/country-commercial-guides/china-ecommerce

- Learn Business In China: Why Study An MBA In Beijing In 2024? - Peking University - Guanghua School of Management, accessed May 13, 2025, https://en.gsm.pku.edu.cn/mba/info/1492/5950.htm

- China's Digital Transformation: How E-Commerce Leaders Are Shaping the Future of Retail, accessed May 13, 2025, https://www.bmes.com/chinas-digital-transformation/

- www.mckinsey.com, accessed May 13, 2025, https://www.mckinsey.com/~/media/mckinsey/locations/asia/greater%20china/our%20insights/2022%20china%20retail%20digitalization%20whitepaper/2022-china-retail-digitalization-whitepaper.pdf

- Top E-Commerce Platforms in China, accessed May 13, 2025, https://gab-china.com/top-e-commerce-platforms-in-china/

- Competition Regulation of Digital Platforms in China - ProMarket, accessed May 13, 2025, https://www.promarket.org/2025/04/01/competition-regulation-of-digital-platforms-in-china/

- Antitrust in China – Review and Outlook 2025 - Gibson Dunn, accessed May 13, 2025, https://www.gibsondunn.com/antitrust-in-china-review-and-outlook-2025/

- Top 7 In-Demand Skills in China for 2025 | Edstellar, accessed May 13, 2025, https://www.edstellar.com/blog/skills-in-demand-in-china

- Protection of Employee Personal Information in China | DLA Piper, accessed May 13, 2025, https://www.dlapiper.com/en-eu/insights/publications/2024/07/protection-of-employee-personal-information-in-china

- The State of AI Jobs, Careers, and Salaries in China (2025), accessed May 13, 2025, https://teamedupchina.com/the-state-of-ai-jobs-careers-and-salaries-in-china/

- How China is getting ready for the future of work | International Labour Organization, accessed May 13, 2025, https://www.ilo.org/resource/news/how-china-getting-ready-future-work

- The Impact of Digitalisation and Automation on China's Workforce: What Does the Future Hold? in - Brill, accessed May 13, 2025, https://brill.com/view/journals/veas/15/1/article-p32_3.xml

- The China imperative for multinational companies - McKinsey Global Institute, accessed May 13, 2025, https://www.mckinsey.com/~/media/mckinsey/mckinsey%20global%20institute/our%20research/the%20china%20imperative%20for%20multinational%20companies/the-china-imperative-for-multinational-companies_vf2.pdf

- Professional Certification Training Courses in China - Simpliaxis, accessed May 13, 2025, https://www.simpliaxis.com/cn

- Global eCommerce Sales Growth From 2021-2027 - Yaguara, accessed May 13, 2025, https://www.yaguara.co/global-ecommerce-sales-growth/

- Ecommerce Careers: The Top 12 eCommerce Jobs to Consider in 2025 - Mayple, accessed May 13, 2025, https://www.mayple.com/resources/ecommerce/ecommerce-careers

- ECommerce Director Jobs - Intelligent People, accessed May 13, 2025, https://www.intelligentpeople.co.uk/ecommerce-director-jobs/

- Emerging Trends in China's E-commerce and Retail Markets - MMG Thailand, accessed May 13, 2025, https://mmgthailand.com/emerging-trends-in-chinas-e-commerce-and-retail-markets/

- (PDF) E-commerce Evolution: A Strategic Analysis of Alibaba's Business Ecosystem, accessed May 13, 2025, https://www.researchgate.net/publication/358199646_E-commerce_Evolution_A_Strategic_Analysis_of_Alibaba's_Business_Ecosystem

- STATISTICAL COMMUNIQUÉ OF THE PEOPLE'S REPUBLIC OF ..., accessed May 13, 2025, https://www.stats.gov.cn/english/PressRelease/202502/t20250228_1958822.html

- Online Shopping in China - Market Research Report (2014-2029) - IBISWorld, accessed May 13, 2025, https://www.ibisworld.com/china/industry/online-shopping/5015/

- China E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) - GII Research, accessed May 13, 2025, https://www.giiresearch.com/report/moi1644573-china-e-commerce-market-share-analysis-industry.html

- China Live Commerce Market Size & Outlook, 2024-2030 - Grand View Research, accessed May 13, 2025, https://www.grandviewresearch.com/horizon/outlook/live-commerce-market/china

- Overview of China's Live Commerce Market: Douyin Case Study, accessed May 13, 2025, https://drpress.org/ojs/index.php/HBEM/article/download/26358/25884/36402

- China Cross-Border E-Commerce Logistics Market Size & Share Analysis - Industry Research Report - Growth Trends - Mordor Intelligence, accessed May 13, 2025, https://www.mordorintelligence.com/industry-reports/china-cross-border-e-commerce-logistics-market

- Can Foreigners Sell in Jingdong (JD.com): A Full Guide - China Legal Experts, accessed May 13, 2025, https://www.chinalegalexperts.com/news/can-foreigners-sell-in-jingdong

- The Future of E-Commerce in China - AHK Greater China, accessed May 13, 2025, https://china.ahk.de/publications/from-bricks-to-clicks-the-future-of-e-commerce-in-china-how-german-brands-can-win-in-chinas-e-commerce-market

- China: Asia's Digital Payments Titan - Thunes, accessed May 13, 2025, https://www.thunes.com/insights/trends/china-asia-digital-payments-titan/

- How China's State-Backed E-Commerce Platforms Threaten American Consumers and U.S. Technology Leadership | ITIF, accessed May 13, 2025, https://itif.org/publications/2025/04/02/chinas-state-backed-e-commerce-platforms-threaten-american-consumers-us-technology-leadership/

- Alibaba's 'New Retail' model HEMA in the spotlight - Kantar, accessed May 13, 2025, https://www.kantar.com/en-cn/Inspiration/Retail/Alibabas-New-Retail-model-HEMA-in-the-spotlight

- Cross-border E-commerce Market Significant Growth By 18201 Billion, accessed May 13, 2025, https://scoop.market.us/cross-border-e-commerce-market-news/

- Chart: How Chinese Companies Make Their Money | Statista, accessed May 13, 2025, https://www.statista.com/chart/34030/revenue-share-of-selected-chinese-companies-by-sector/

- 29 Social Commerce Statistics & Trends For 2025 - Blogging Wizard, accessed May 13, 2025, https://bloggingwizard.com/social-commerce-statistics/

- JD.com - Wikipedia, accessed May 13, 2025, https://en.wikipedia.org/wiki/JD.com

- China Social Commerce Intelligence Report 2025: Market to - GlobeNewswire, accessed May 13, 2025, https://www.globenewswire.com/de/news-release/2025/05/08/3077093/28124/en/China-Social-Commerce-Intelligence-Report-2025-Market-to-Reach-769-Billion-by-2030-Driven-by-Platform-Innovations-Strategic-Partnerships-and-Significant-Investments.html

- Livestreaming plays key role in growth - Chinadaily.com.cn, accessed May 13, 2025, https://www.chinadaily.com.cn/a/202505/13/WS68229ceda310a04af22bee6a.html

- (This appears to be the same as ref36, used in context of live stream user numbers.)

- (PDF) Toward Digital Transformation: Insights into Chinese Cross-Border E-Commerce SMEs During the COVID-19 Pandemic and the Post-Pandemic Era - ResearchGate, accessed May 13, 2025, https://www.researchgate.net/publication/388708623_Toward_Digital_Transformation_Insights_into_Chinese_Cross-Border_E-Commerce_SMEs_During_the_COVID-19_Pandemic_and_the_Post-Pandemic_Era

- 2025 Salary outlook: Trends and predictions for Chinese industries - WTW, accessed May 13, 2025, https://www.wtwco.com/en-hk/insights/2025/03/2025-salary-outlook-trends-and-predictions-for-chinese-industries

- The Age of New Retail in China, accessed May 13, 2025, https://retailstoretours.com/blogs/rst-journal/the-age-of-new-retail-in-china

- Top Skills for Remote Jobs in China - Himalayas.app, accessed May 13, 2025, https://himalayas.app/remote-work-statistics/jobs/skills/countries/china

- China Social Commerce Market Intelligence Report 2025: Douyin and Xiaohongshu Leading the Integration of Social Interaction and Online Shopping - Future Growth Dynamics to 2030 - ResearchAndMarkets.com - Business Wire, accessed May 13, 2025, https://www.businesswire.com/news/home/20250509699622/en/China-Social-Commerce-Market-Intelligence-Report-2025-Douyin-and-Xiaohongshu-Leading-the-Integration-of-Social-Interaction-and-Online-Shopping---Future-Growth-Dynamics-to-2030---ResearchAndMarkets.com

- Philips Jobs in China, accessed May 13, 2025, https://www.careers.philips.com/global/en/philips-jobs-in-china?from=10&s=1&rk=l-philips-jobs-in-china

- Analyst Business E-Commerce Salary Nanjing, China - SalaryExpert, accessed May 13, 2025, https://www.salaryexpert.com/salary/job/analyst-business-e-commerce/china/nanjing

- Full article: Analyzing Key Opinion Leaders' Live Commerce Strategies in a Cross-Cultural Environment: Insights from Japan–China e-Commerce - Taylor and Francis, accessed May 13, 2025, https://www.tandfonline.com/doi/full/10.1080/08961530.2025.2468216?src=exp-la

- (The original document mentioned "Suning is a major player in electronics and home appliances" - if a specific source for Suning's details beyond platform lists was present in the original bibliography, it would be listed here.)

- (This refers to the general platform differentiation mentioned in the text, often synthesized from platform overview sources like #1 or #5.)

- E-commerce Manager for YeeHoo(Y) | HiredChina - Jobs in China for Expats, accessed May 13, 2025, https://www.hiredchina.com/jobs/e6fd6009-4ab6-4bc0-b19c-eee3131e6af0

- (This refers to the need for agility and compliance in the regulatory environment discussed with sources #6, #7, #9, #29.)

- (This refers to the need for understanding antitrust, discussed with sources #6, #7.)

- Salary China, E-Commerce Specialist, Commerce - Paylab, accessed May 13, 2025, https://www.paylab.com/cn/salaryinfo/commerce/e-commerce-specialist

- China Social Commerce Intelligence Report 2025: Market to Reach $769 Billion by 2030, Driven by Platform Innovations, Strategic Partnerships, and Significant Investments - GlobeNewswire, https://www.globenewswire.com/news-release/2025/05/08/3077093/0/en/China-Social-Commerce-Intelligence-Report-2025-Market-to-Reach-769-Billion-by-2030-Driven-by-Platform-Innovations-Strategic-Partnerships-and-Significant-Investments.html (This is another link for the same GlobeNewswire report as #35, providing context for social/live commerce.)

- (This refers to AI and product recommendations, contextually from source #3.)

- (This refers to AI streamlining customer service, contextually from source #3.)

- (This refers to Shein/Temu expansion, contextually from source #35.)

- 9 Chinese digital marketing trends to know for 2025 - Market Me China®, accessed May 13, 2025, https://www.marketmechina.com/9-chinese-digital-marketing-trends-to-know-for-2025/

- Top 10 In-Demand Jobs for 2025 | Hays China, accessed May 13, 2025, https://www.hays-china.cn/en/blog/top-10-jobs-china

- Top Talent Trends In Recruitment 2025 - Robert Walters US, accessed May 13, 2025, https://www.robertwalters.us/insights/hiring-advice/e-guide/top-talent-trends-in-recruitment.html

- Launch of Robert Walters 2025 Salary Survey, accessed May 13, 2025, https://www.ecct.com.tw/launch-of-robert-walters-2025-salary-survey/

- How Studying In China Helped Me Launch A Global Career In Finance - BusinessBecause, accessed May 13, 2025, https://www.businessbecause.com/news/mba-degree/9754/from-mexico-to-china?sponsored=tsinghua-university

- E-commerce Manager Salary in China 2025 - Jobicy, accessed May 13, 2025, https://jobicy.com/salaries/cn/e-commerce-manager

- IT e-Commerce Marketing Manager Salary Shenzhen, China - SalaryExpert, accessed May 13, 2025, https://www.salaryexpert.com/salary/job/it-e-commerce-marketing-manager/china/shenzhen

- e-Commerce Specialist Salary Shenzhen, China - SalaryExpert, accessed May 13, 2025, https://www.salaryexpert.com/salary/job/e-commerce-specialist/china/shenzhen

- Business Analyst Salary in China | Robert Half, accessed May 13, 2025, https://www.roberthalf.cn/cn/en/job-details/business-analyst/china

- Inside a 6-hour e-commerce livestream in China - Marketplace, accessed May 13, 2025, https://www.marketplace.org/2020/01/16/taobao-livestream-alibaba/

- (This note from the original document related to salary table variation and caution about Paylab data, linked to source #51.)

- China's livestream hosts are vulnerable to labour rights violations as workers in the gig economy, accessed May 13, 2025, https://clb.org.hk/en/content/china%E2%80%99s-livestream-hosts-are-vulnerable-labour-rights-violations-workers-gig-economy