A definitive guide for companies navigating China's dynamic digital marketing talent landscape

Executive Summary

China's digital landscape presents a unique and rapidly evolving environment for marketers.

Characterized by hyper-growth, dominant domestic platforms, and a deeply integrated mobile-first ecosystem, understanding the nuances of digital marketing in China is crucial for international businesses and professionals seeking opportunities.

This report provides a comprehensive overview of the current state of digital marketing in China, covering the market landscape, in-demand roles, competitive salaries, essential skills, key platforms and strategies, prevalent challenges, and future trends shaping this dynamic industry.

Hiring in China?

Post open roles across China’s top job sites, classifieds, and networking platforms — lower hiring costs by over 80%.

Table of Contents

Toggle1. China’s Digital Marketing Landscape: Hyper-Growth and Innovation

China's advertising market is not only vast but also undergoing a profound digital transformation, setting it apart from global trends and establishing a unique ecosystem where digital channels reign supreme.

1.1 The Scale of China’s Advertising Market

China's overall advertising industry demonstrated significant strength in 2024, with total revenues surging past 1.5 trillion yuan (approximately $208.1 billion USD), marking a robust 17.9 percent year-on-year growth [1]. This expansion underscores the advertising sector's strong connection to the real economy and domestic consumption growth [1].

On the global stage, China stands as the second-largest advertising market, trailing only the United States [2]. While total ad spend relative to GDP is significant, it remains slightly lower than rates seen in the US and UK [3]. Estimates of China's total ad spend vary slightly by source, with figures around $179.7 billion USD cited for 2022 by one source [2] and $166.13 billion USD by another for the same year [4]. Regardless of minor variations, the sheer scale highlights the immense importance of advertising within the Chinese economy.

1.2 Digital Dominance: Market Size, Growth, and Forecasts

Within the broader advertising industry, internet advertising is the undisputed leader in China. In 2024, revenues from internet advertising reached an impressive 891.91 billion yuan, reflecting a 24 percent year-on-year increase [1]. This segment claimed a staggering 86.5 percent share of the total advertising revenue across all media platforms in China [1].

This dominance is significantly higher than the global average, where digital channels accounted for approximately 72.7 percent of worldwide ad investment in 2024 [3], [29].

This accelerated shift suggests a unique market structure in China where digital is not merely a channel, but the primary ecosystem for communication, content consumption, and commerce.

Estimates for the precise size of China's digital advertising market vary. Grandview Research placed the market at $53.4 billion USD in 2024, forecasting a rise to $145.4 billion USD by 2030, driven by a compound annual growth rate (CAGR) of 18 percent between 2025 and 2030 [5]. Consultancy R3 reported a 15.5 percent growth in digital advertising revenue for 2023 [6]. Globally, digital ad spend saw double-digit growth, though forecasts suggest a slight deceleration in the coming years [7], [3].

The consistent theme across reports is the powerful, ongoing expansion of China's digital advertising sector, far outpacing traditional media investment [6], [8]. By 2024, digital ad spend in China was projected to be more than twice as large as traditional media spend [4].

1.3 Key Drivers: Mobile, E-commerce, and Platform Ecosystem

Several core factors fuel China's digital marketing boom:

Mobile-First Reality: China operates fundamentally as a mobile-first nation. Official statistics indicated that as of June 2019, 99.1% of China's internet users (then over 854 million) accessed the web via smartphones [9]. With over 1.3 billion internet users today [10], this mobile dependency remains absolute. Consequently, mobile advertising constitutes the largest and fastest-growing segment of digital ad spend, accounting for 55.6% in 2024 [5].

This aligns with the global trend where mobile captured nearly two-thirds of digital ad investments in 2024 [29]. This reality mandates that virtually all marketing strategies must be mobile-optimized from the ground up. Mobile payment is also ubiquitous, further cementing the smartphone's central role in daily life and commerce [9].

- E-commerce Integration: China hosts the world's largest and most dynamic e-commerce market [11], [12], projected to reach approximately $2.31 trillion USD by 2029 [12]. Platforms like Alibaba's Taobao/Tmall, JD.com, Pinduoduo, and increasingly social platforms like Douyin and Kuaishou, seamlessly blend advertising, content, and shopping experiences [5], [13].

Livestreaming e-commerce

has become a dominant force, turning product discovery into entertainment and driving massive sales volumes, with projections suggesting it could become a 1 trillion RMB market in 2025 [14], [15]. This deep integration means marketing efforts often lead directly to transactions within the same digital journey, blurring the lines between engagement and conversion. - Platform Dominance: The digital landscape is controlled by a handful of powerful domestic platforms, often referred to as "super apps." WeChat, Douyin, Xiaohongshu, Kuaishou, and Weibo boast user bases ranging from hundreds of millions to over a billion monthly active users (MAU) [16], [17], [10]. These are not merely social networks; they are integrated ecosystems encompassing messaging, content consumption, social sharing, e-commerce, payments, and mini-programs (apps within apps) [16], [9], [13]. Success requires a nuanced understanding of each platform's unique user base, content formats, and marketing capabilities.

1.4 Influencing Factors: Economy and Regulatory Landscape

The digital marketing environment is also shaped by broader economic and regulatory forces:

- Economic Conditions: China's economy continues to grow, with GDP growth reported at 5.2% in 2023 and 5.0% in 2024 [18], [19]. However, recent surveys indicate some weakening in consumer sentiment, potential deflationary pressures, and relatively high household savings rates, which could temper retail spending growth [20]. Despite these headwinds, the sheer size of China's consumer base (over 1.4 billion people) and its expanding middle-income group (over 400 million) provide a foundation for sustained consumption in the medium to long term [20]. Marketing strategies may need to adapt, potentially emphasizing value, necessity, or emotionally resonant campaigns that align with more rational spending patterns [13].

- Regulatory Environment (PIPL Focus): Navigating China's complex and evolving regulatory landscape is paramount. Several laws impact data handling and marketing practices, including the Cybersecurity Law (CSL, 2017), the Data Security Law (DSL, 2021), and most significantly for marketers, the Personal Information Protection Law (PIPL, effective November 1, 2021) [18], [21], [22].

- PIPL's Core Tenets: Similar in spirit to the EU's GDPR, PIPL grants individuals significant rights over their personal data, including rights to access, correct, delete, and withdraw consent [23], [21], [24]. It applies extraterritorially, affecting any organization processing the personal information of individuals within China, regardless of where the organization is based, if the purpose is to provide products/services or analyze behavior within China [23], [21], [22].

- Consent and Data Handling: PIPL mandates a high standard for consent, requiring separate, explicit consent for processing sensitive personal information, transferring data overseas, and conducting direct marketing [22]. It prohibits illegal collection, use, or sale of personal data and forbids misleading or coercive data handling practices [25].

- Algorithmic Regulation: PIPL addresses the use of algorithms for automated decision-making and recommendations, requiring transparency and providing users the right to opt-out of personalized recommendations [21], [26].

- Compliance Obligations: Organizations may need to appoint Data Protection Officers (DPOs), conduct regular data protection impact assessments (DPIAs) and compliance audits, and implement robust security measures (encryption, access controls) [27], [24], [22].

- Severe Penalties: Non-compliance carries significant risks, including fines up to 50 million RMB or 5% of the company's previous year's turnover, orders to suspend operations, and personal fines up to 1 million RMB for individuals directly responsible [21], [26], [24].

- Other Relevant Regulations: Beyond PIPL, marketers must also be mindful of regulations governing e-commerce operations (consumer rights, fair competition, IP protection, product safety), advertising standards, content restrictions (including the "Great Firewall" and censorship), and data localization requirements under the CSL and DSL [12], [28], [27].

PIPL's Impact: The stringent requirements of PIPL, particularly around consent and data usage, are fundamentally reshaping data-driven marketing in China. The increased risks and costs associated with processing large volumes of third-party data push organizations towards strategies built on transparency, trust, and first-party data relationships.

Approaches like building "private traffic" pools within controlled environments like WeChat groups [29], [30] or leveraging Key Opinion Consumers (KOCs) known for authentic reviews [31], [32] become more strategically valuable. PIPL, therefore, acts less as a simple barrier and more as an accelerator for marketing approaches focused on genuine engagement and direct customer relationships, rather than purely data extraction.

2. In-Demand Digital Marketing Roles and Competitive Salaries

The dominance of digital channels has reshaped the marketing talent landscape in China, creating strong demand for professionals with specialized digital skills and offering competitive compensation packages, particularly in major urban centers.

2.1 Mapping the Marketing Career Landscape

The rapid digitalization of China's economy has fueled demand for a new breed of marketing professionals. Traditional marketing roles are evolving, while entirely new specializations focused on digital platforms, e-commerce, and data analytics have emerged. Job postings frequently highlight positions such as Digital Marketing Specialist, Social Media Manager, E-commerce Marketing Manager, Content Creator (often requiring Mandarin fluency), and KOL/Influencer Marketing Manager [33], [34]. Expertise in specific Chinese platforms like WeChat, Douyin, Xiaohongshu (RED), and Weibo is often explicitly required [34], [35], [36], [37]. Even traditional roles like Brand Manager and Marketing Manager now necessitate significant digital capabilities, including managing online campaigns, driving e-commerce performance, and understanding digital consumer behavior [33], [38], [39].

2.2 Key Digital Marketing Roles & Responsibilities

Several key roles define the digital marketing function in China:

- Digital Marketing Manager/Specialist: Develops and executes overarching digital strategies across channels like web, SEO/SEM (Baidu), social media, email, and paid advertising. Manages campaign execution, analyzes performance data, tracks KPIs, and often oversees budgets [33], [35]. Requires deep familiarity with the Chinese digital ecosystem (WeChat, RED, Weibo, Douyin, etc.) [35].

- Social Media Manager: Creates and implements strategies tailored to specific Chinese social platforms (WeChat, Weibo, Douyin, Xiaohongshu, etc.). Manages brand accounts, develops engaging content, fosters community interaction, monitors trends, and analyzes platform performance [33], [34], [36], [37]. Fluency in Mandarin and strong cultural understanding are typically essential [33], [37].

- Content Creator/Manager: Produces compelling and culturally relevant content (short videos, articles, social media posts, visuals) optimized for Chinese platforms and audiences [33], [34]. Often requires native-level Mandarin skills.

- E-commerce Marketing Manager: Focuses on driving sales and managing brand presence on China's major e-commerce platforms (e.g., Tmall, JD.com, Pinduoduo) and integrated social commerce channels (e.g., Douyin, Kuaishou stores) [13], [14]. Responsibilities include managing online storefronts, planning promotions, analyzing sales data, and optimizing the customer journey.

- KOL/Influencer Marketing Manager: Develops and executes strategies involving Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs). Identifies relevant influencers, negotiates partnerships, manages campaign execution and budgets across platforms like Xiaohongshu, Weibo, and Douyin, and tracks ROI [33], [34], [31], [40].

- Performance Marketing Specialist: Concentrates on optimizing paid advertising campaigns (SEM on Baidu, social media ads, programmatic display) to achieve specific conversion goals and maximize ROI [44], [35]. Relies heavily on data analysis, A/B testing, and understanding performance metrics.

- Brand Manager: While traditionally broader, this role increasingly incorporates digital responsibilities. This includes shaping the online brand narrative, ensuring consistency across digital touchpoints, overseeing digital communication strategies, and integrating digital efforts with overall brand goals [38], [39]. Requires understanding digital trends and consumer insights [43].

- Marketing Analyst: Specializes in analyzing market data, campaign results, consumer behavior patterns, and competitive intelligence to provide actionable insights that inform marketing strategy and optimization [42], [43].

The following table summarizes key digital marketing roles prevalent in the Chinese market:

| Role Title | Core Responsibilities (China Context) | Key Skills Required | Typical Employers |

|---|---|---|---|

| Digital Marketing Manager/Specialist | Develops & executes integrated digital strategy (Social, SEO/SEM on Baidu, Paid Media, Content) across China-specific platforms; Manages campaigns & budgets; Analyzes performance. | Platform Expertise (WeChat, Douyin, RED, Weibo, Baidu), Data Analysis, Campaign Management, Budgeting, Mandarin (often preferred/required). | MNCs, Local Tech Companies, E-commerce Platforms, Agencies, Startups. |

| Social Media Manager | Manages brand presence on key Chinese platforms (WeChat, Weibo, Douyin, RED); Develops platform-specific content & engagement strategies; Manages communities; Tracks metrics. | Platform Expertise, Content Creation (Mandarin essential), Community Management, Analytics, Cultural Fluency. | MNCs, Local Brands, Agencies, Media Companies. |

| E-commerce Marketing Manager | Drives sales on platforms like Tmall, JD.com, Pinduoduo, Douyin Store, Kuaishou Store; Manages online store operations, promotions, and platform relationships; Analyzes sales data. | Platform Expertise (Tmall/JD/Pinduoduo/Douyin/Kuaishou), Sales Analysis, Promotion Planning, Digital Advertising, Supply Chain Awareness. | Brands (MNC & Local), E-commerce Platforms, Retailers. |

| KOL/KOC Marketing Manager | Develops influencer strategy; Identifies, vets, and manages relationships with KOLs & KOCs; Executes campaigns on platforms like RED, Douyin, Weibo; Tracks performance & ROI. | Influencer Identification & Management, Negotiation, Campaign Execution, Platform Expertise (esp. RED, Douyin), Relationship Building, Budget Management. | Agencies, MNCs, Local Brands (especially consumer goods, fashion, beauty). |

| Content Creator/Strategist | Creates engaging and culturally resonant content (video, articles, visuals) for Chinese digital channels; Develops content calendars and strategies. | Mandarin Fluency (Native preferred), Creative Writing/Storytelling, Video Production/Editing (esp. short video), Platform Optimization, Cultural Sensitivity. | Agencies, Media Companies, Brands (In-house teams). |

| Performance Marketing Specialist | Manages paid advertising campaigns (Baidu SEM, social ads, display); Optimizes for conversions & ROI; Conducts A/B testing; Analyzes campaign data deeply. | SEM (Baidu), Paid Social Advertising (WeChat, Douyin, Weibo), Data Analysis, Conversion Rate Optimization (CRO), Analytics Tools. | Agencies, E-commerce Companies, Tech Companies, Performance-focused Brands. |

| Brand Manager (Digital Focus) | Develops overall brand strategy with strong digital integration; Oversees online brand communication & presence; Ensures consistency across digital channels; Leverages digital insights for brand building. | Brand Strategy, Digital Marketing Principles, Market Analysis, Consumer Insights, Cross-functional Collaboration, Communication Skills. | MNCs, Large Local Companies (Consumer Goods, Automotive, etc.). |

2.3 Salary Benchmarks and Influencing Factors

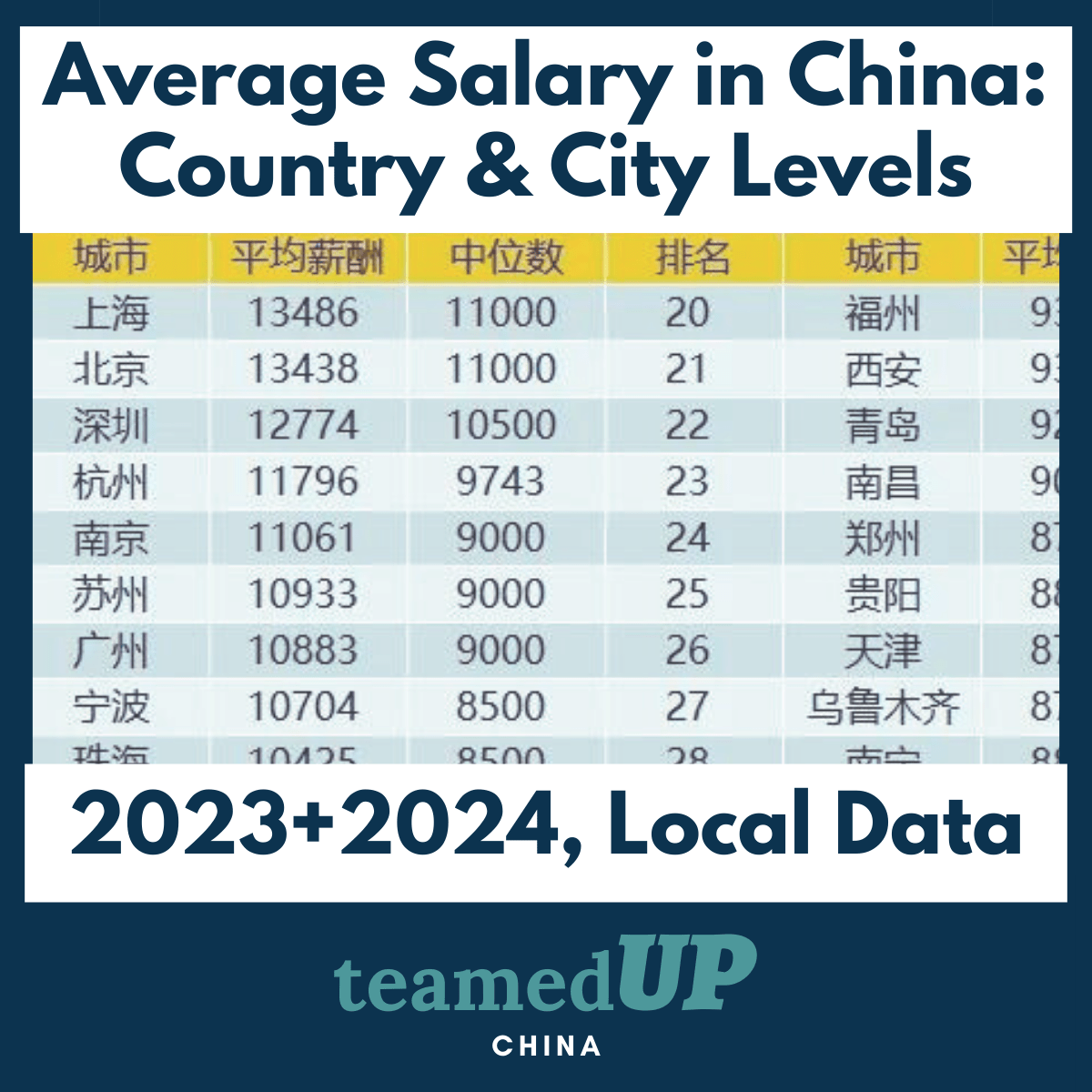

Compensation for digital marketing roles in China is competitive but varies significantly based on several factors. Obtaining precise, universally applicable figures is challenging due to data fragmentation and the proprietary nature of many salary surveys [45], [46], [47]. However, available data points provide useful benchmarks:

- Marketing Manager (General): SalaryExpert estimates the average gross salary for a Marketing Manager in China at ¥453,306 CNY (approx. $63,500 USD) annually, with an average bonus of ¥52,901 CNY (approx. $7,400 USD). Entry-level positions (1-3 years) average around ¥251,708 CNY ($35,200 USD), while senior-level roles (8+ years) can reach ¥585,456 CNY ($82,000 USD) [43]. Plane.com reports a median salary of $53,413 USD for remote Marketing Managers in China [48].

- Digital Marketing Specialist: ERI estimates the average salary for this role across China at ¥223,703 CNY (approx. $31,300 USD), with a typical range of ¥158,829 CNY to ¥270,680 CNY ($22,200 - $37,900 USD) and an average bonus of ¥7,584 CNY (approx. $1,060 USD) [49].

- Advertising Specialist: In Shenzhen, a Tier 1 city, the average salary is estimated at ¥209,205 CNY (approx. $29,300 USD), ranging from ¥148,954 CNY to ¥252,720 CNY ($20,800 - $35,400 USD). The average in Shanghai is higher, estimated at ¥225,000 CNY ($31,500 USD) [50].

Several factors influence these salary levels:

- Location: Tier 1 cities like Shanghai, Beijing, and Shenzhen consistently offer higher salaries compared to lower-tier cities, often by 15-25% or more, reflecting the higher cost of living and concentration of major companies [51], [50].

- Experience: Years of relevant experience and demonstrated expertise significantly impact earning potential. Senior-level professionals command substantially higher salaries than entry-level or mid-career individuals [43].

- Company Type: Multinational corporations (MNCs) and large domestic tech giants (e.g., Alibaba, Tencent, ByteDance) generally offer more competitive compensation packages, which may include substantial bonuses, equity options, or comprehensive benefits, compared to smaller local firms or traditional companies [51], [52].

- Industry Specialization: Salaries can vary depending on the industry sector the company operates in, with high-growth or highly profitable sectors potentially offering premiums.

- Education and Skills: Advanced degrees (Master's, PhD) or specialized, in-demand skills (e.g., AI in marketing, advanced data analytics) can command higher salaries [51].

- Negotiation: Candidates who research market rates and effectively articulate their value proposition can often negotiate better compensation packages. Job movers frequently expect salary increments, potentially ranging from 5-20% depending on demand and role [45], [47].

The table below provides estimated salary ranges based on available data and common influencing factors. Note that these are estimates and actual salaries can vary.

| Role Title | Experience Level | Location Tier | Annual Salary Range (RMB) | Annual Salary Range (USD) | Notes |

|---|---|---|---|---|---|

| Digital Marketing Specialist | Junior (1-3 yrs) | Tier 1 | ¥150,000 - ¥250,000 | $21,000 - $35,000 | Bonuses typically smaller percentage of total comp compared to Manager level. Lower ranges in Tier 2/3 cities. |

| Mid (3-7 yrs) | Tier 1 | ¥220,000 - ¥350,000 | $30,800 - $49,000 | ||

| Senior (7+ yrs) | Tier 1 | ¥300,000 - ¥500,000+ | $42,000 - $70,000+ | ||

| Social Media Manager | Junior (1-3 yrs) | Tier 1 | ¥160,000 - ¥260,000 | $22,400 - $36,400 | High demand, especially with platform-specific expertise. Mandarin fluency often mandatory. |

| Mid (3-7 yrs) | Tier 1 | ¥250,000 - ¥400,000 | $35,000 - $56,000 | ||

| Senior (7+ yrs) | Tier 1 | ¥350,000 - ¥600,000+ | $49,000 - $84,000+ | ||

| E-commerce Marketing Manager | Junior (1-3 yrs) | Tier 1 | ¥180,000 - ¥300,000 | $25,200 - $42,000 | Strongly linked to sales performance; bonuses can be significant. Experience with major platforms (Tmall, JD, Douyin) valued. |

| Mid (3-7 yrs) | Tier 1 | ¥280,000 - ¥450,000 | $39,200 - $63,000 | ||

| Senior (7+ yrs) | Tier 1 | ¥400,000 - ¥700,000+ | $56,000 - $98,000+ | ||

| Marketing Manager (Digital Focus) | Junior (1-3 yrs) | Tier 1 | ¥250,000 - ¥380,000 | $35,000 - $53,200 | Reflects broader strategic responsibility. Senior roles often overlap with Director level. Significant bonus potential (15-30%+). MNCs may offer higher packages. |

| Mid (3-7 yrs) | Tier 1 | ¥350,000 - ¥550,000 | $49,000 - $77,000 | ||

| Senior (8+ yrs) | Tier 1 | ¥500,000 - ¥900,000+ | $70,000 - $126,000+ |

Note: USD conversions based on approximate exchange rate of 1 USD = 7.15 CNY. Ranges are estimates and subject to variation based on company, industry, specific skills, and negotiation. Tier 1 cities include Shanghai, Beijing, Shenzhen, Guangzhou.

2.4 Career Paths and Progression

Career progression in China's digital marketing field typically follows a path from specialist roles to managerial and then director-level positions [33], [42], [38]. An individual might start as a Digital Marketing Specialist, Social Media Coordinator, or Content Creator. With experience, they can advance to Manager roles overseeing specific functions (e.g., Social Media Manager, E-commerce Marketing Manager) or broader digital strategy (Digital Marketing Manager). Further progression leads to Director or Head of Marketing/Digital positions, involving greater strategic oversight, team leadership, and budget responsibility [39].

Alternatively, deep specialization can lead to expert-track roles, such as Head of Performance Marketing or Principal SEO Strategist. Movement between different types of organizations – from agencies to in-house roles at MNCs or local tech firms, and even to platform companies like Tencent or ByteDance – is common and can provide diverse experience. Key factors driving advancement include developing strong leadership and management capabilities, demonstrating strategic thinking, fostering cross-functional collaboration, achieving measurable results, and continuously updating skills to keep pace with the rapidly changing digital landscape [42], [38], [39]. Pursuing additional training or certifications, such as specialized bootcamps, can also support career growth [53].

3. Essential Skills for Success in China’s Digital Marketing Arena

Thriving in China's fast-paced digital marketing environment requires a blend of foundational marketing knowledge, deep platform expertise, strong analytical capabilities, and crucial cultural competencies.

3.1 Foundational Marketing & Communication Skills

A solid grounding in core marketing principles remains essential. This includes understanding brand strategy development, market segmentation, consumer behavior, and campaign planning and execution [35], [42], [39]. Perhaps most critical, however, are communication skills tailored to the Chinese context. Excellent proficiency in both written and spoken Mandarin Chinese is often a non-negotiable requirement, particularly for roles involving content creation, social media management, community engagement, or direct interaction with local teams, partners, and customers [33], [34], [35], [37].

Beyond language, a deep cross-cultural understanding is vital. This involves sensitivity to local nuances, social etiquette, consumer attitudes (which can differ significantly from Western markets), and awareness of cultural trends like the rise of "Guochao" (national pride in Chinese brands and culture) [28], [54], [55]. Effective localization goes far beyond translation; it requires adapting messaging, visuals, and overall strategy to resonate authentically with the target audience [28].

3.2 Critical Platform-Specific Expertise

Given the unique and consolidated nature of China's digital ecosystem, deep familiarity with the dominant domestic platforms is indispensable. This includes not just knowing the names, but understanding the specific functionalities, user demographics, content formats, advertising options, and cultural context of platforms like:

- WeChat: Mastery of Official Accounts for content distribution and CRM, Mini Programs for e-commerce and services, WeChat Pay for transactions, and WeChat Channels for video content [16], [10], [35].

- Douyin: Expertise in creating engaging short videos, leveraging its powerful recommendation algorithm, utilizing Douyin Stores for e-commerce, and running effective livestreaming campaigns [16], [14], [35].

- Xiaohongshu (RED): Understanding how to leverage its community-driven nature for product seeding, generating authentic user-generated content (UGC) or "Rednotes", and working with KOLs/KOCs for reviews and recommendations [16], [32], [14], [35].

- Weibo: Knowing how to utilize it for disseminating news, tapping into trending topics, engaging with celebrities and KOLs, and managing public relations [17], [35].

- Kuaishou: Understanding its user base (stronger in lower-tier cities) and leveraging its short video and livestreaming e-commerce features [17], [10], [13].

- Bilibili: Knowing how to engage its predominantly Gen Z audience through longer-form video, livestreaming, and content relevant to ACG (Anime, Comics, Games) culture [13].

- Baidu: Proficiency in Search Engine Optimization (SEO) and Search Engine Marketing (SEM) specific to Baidu's algorithms and user behavior [35], [28].

Marketers must be able to tailor strategies and content effectively for each platform's unique environment [35], [37].

3.3 Data Analysis and Performance Marketing Acumen

In a market where demonstrating return on investment (ROI) is paramount, strong analytical skills are crucial. Chinese CMOs increasingly prioritize metrics like Sales Growth, Profit Growth, and Conversion Rates [44]. Marketers need proficiency in using various analytics tools (both platform-native and third-party) to monitor campaign performance, track key metrics, interpret data, and generate actionable insights for optimization [35], [37], [43]. Experience with A/B testing methodologies is valuable for refining campaigns.

Furthermore, a solid understanding of performance marketing channels – including SEM on Baidu, paid social advertising across platforms like WeChat and Douyin, and programmatic buying – along with relevant metrics (CPM, CPC, CPA, ROAS) is essential, especially given the reported trend of performance marketing consuming a large share (60-70%) of marketing budgets [44], [56].

3.4 Emerging Skill Requirements

The landscape continues to evolve, demanding new competencies:

- AI in Marketing: Understanding the application of Artificial Intelligence for enhanced personalization, automated customer service (chatbots), AI-driven content generation (including virtual influencers), predictive analytics, and optimizing ad targeting is becoming increasingly important [57], [44], [59], [60]. China shows high growth in demand for AI specialists generally [57], [58].

- Video Marketing Expertise: Proficiency in creating compelling short-form video content tailored for platforms like Douyin and Kuaishou is a core requirement [15], [14], [60]. Understanding the dynamics of livestreaming e-commerce, including host interaction and real-time sales techniques, is also highly valuable [15], [41].

- Advanced Content & Storytelling: Beyond basic creation, the ability to craft authentic narratives that resonate culturally, potentially using innovative formats like branded mini-series or interactive content, is key to cutting through the noise [14], [44], [28].

- MarTech Savviness: Familiarity with relevant Marketing Technology tools, including marketing automation platforms, Customer Relationship Management (CRM) systems (both global potentially adapted for China like HubSpot, and potentially local solutions), and data management platforms is beneficial [61], [62].

- Cybersecurity & Data Privacy Awareness: Given the stringent PIPL regulations, a fundamental understanding of data protection principles, consent management, and security best practices is becoming a necessary baseline skill for all marketers handling customer data [18], [12], [22], [58].

The convergence of these demands signifies a growing need for 'hybrid' marketers in China.

Success increasingly requires professionals who can seamlessly blend creative content generation and storytelling skills with robust analytical capabilities for performance measurement and optimization, alongside the technical knowledge to navigate China's unique and complex platform ecosystem effectively.

Marketers who can bridge strategy, creativity, data, and technology within this specific cultural context are likely to be the most sought-after.

4. Dominant Platforms and Winning Digital Strategies

China's digital marketing success hinges on mastering its unique ecosystem of dominant platforms and employing strategies tailored to their specific functionalities and user behaviors.

4.1 China’s Unique Platform Ecosystem

Unlike Western markets dominated by global players like Google, Facebook, and Instagram, China's digital sphere is governed by powerful domestic platforms that integrate social interaction, content consumption, e-commerce, and services into seamless "super app" experiences [16], [28]. Understanding the key players is fundamental:

- WeChat (微信): With over 1.3 billion MAU, WeChat is ubiquitous [16], [17]. It's essential for building customer relationships (CRM) via Official Accounts, engaging communities through WeChat Groups (key for "private traffic"), offering services and e-commerce via Mini Programs, facilitating payments (WeChat Pay), and sharing video content through WeChat Channels [16], [10], [29]. Its user base spans all demographics and geographic tiers [17], [10].

- Douyin (抖音): The Chinese version of TikTok boasts over 750-800 million MAU [16], [10]. It dominates short-form video and is a primary platform for brand discovery, entertainment, and increasingly, integrated e-commerce through Douyin Stores and highly popular livestreaming sessions [16], [13], [14]. While historically skewing younger (Gen Z), its user base is broadening [17], [10].

- Xiaohongshu (小红书) / RED: With around 300 million MAU, RED is a powerful social commerce platform focused on lifestyle, fashion, beauty, and travel [16]. It functions as a key discovery and research tool, heavily influencing purchase decisions through user-generated content (UGC) in the form of "notes" (笔记) and recommendations from KOLs and KOCs [16], [31], [14], [54]. Its user base is predominantly young and female. High demand for advertising is reflected in expected rate card increases [6].

- Kuaishou (快手): A major competitor to Douyin in the short video space, with over 600 million MAU [17], [10]. Kuaishou has a particularly strong user base in lower-tier cities and rural areas, offering significant reach outside major urban centers [17]. It also features robust livestreaming e-commerce capabilities [13], [32]. Users spend an average of 122 minutes per day on the platform [10].

- Sina Weibo (新浪微博): Often described as "China's Twitter," Weibo has over 600 million MAU [17]. It's a primary platform for real-time news, public discourse, following trends, and engaging with celebrities and KOLs [17], [54]. Its user base tends to be younger (18-30) [17].

- Bilibili (哔哩哔哩): A video platform immensely popular with China's Gen Z, known for its focus on ACG (Anime, Comics, Games) content, user-generated videos, livestreaming, and a strong community culture [17], [13].

- Other Key Platforms: Include Zhihu (知乎), a Q&A platform similar to Quora, valuable for expert positioning and in-depth content [17], [10]; Douban (豆瓣), focused on book, movie, and music reviews and interest-based groups [17], [10]; and the major dedicated e-commerce platforms like Taobao/Tmall (Alibaba), JD.com, and Pinduoduo, which also offer sophisticated advertising and marketing tools [5], [13], [41].

The following table offers a comparative overview of these key platforms:

| Platform Name | Estimated MAU | Primary User Demographics | Key Content Formats | Core Use Cases for Marketing | Key Features for Marketers |

|---|---|---|---|---|---|

| WeChat (微信) | 1.3B+ [16], [17] | Broad; All ages & tiers; Slightly more male (54%) [16], [17] | Articles, Short Video (Channels), Messaging, Mini Programs | CRM, Private Traffic, Customer Service, E-commerce (Mini Programs), Payments, Brand Building | Official Accounts, Mini Programs, WeChat Pay, WeChat Channels, Moments Ads, Group Management |

| Douyin (抖音) | 750-800M+ [16], [10] | Younger; Balanced gender; Strong in Tier 1/2, growing in lower tiers | Short Video, Livestreaming | Brand Awareness, Viral Marketing, E-commerce (Direct Sales), KOL Marketing, Lead Generation | In-feed Ads, Hashtag Challenges, Branded Effects, Douyin Stores, Livestreaming Tools, KOL Platform |

| Xiaohongshu (小红书) / RED | ~300M [16] | Younger (Gen Z/Millennial); Predominantly Female; Urban focus | Image/Video Notes (UGC), Livestreaming, Articles | Brand/Product Discovery, Community Building, KOL/KOC Marketing, UGC Campaigns, E-commerce (Seeding) | Official Brand Accounts, Keyword Search Ads, Influencer Collaboration Platform, Product Tagging, Livestreaming |

| Kuaishou (快手) | 600M+ [17], [10] | Slightly older than Douyin; Balanced gender; Strong in Lower-Tier Cities & Rural Areas | Short Video, Livestreaming | Reaching Lower-Tier Markets, E-commerce, KOL Marketing, Brand Awareness | In-feed Ads, Livestreaming E-commerce Tools, Kuaishou Stores, KOL Platform |

| Sina Weibo (新浪微博) | 600M+ [17] | Younger; Slightly more male (56%) [17]; Broad geographic reach | Microblogging (Text, Image, Video), Livestreaming, Articles | News Dissemination, Trend Monitoring, KOL/Celebrity Engagement, PR & Crisis Management, Brand Announcements | Promoted Feeds, Fan Headlines, Topic Sponsorship, Official Accounts, Weibo Search Ads |

| Bilibili (哔哩哔哩) | ~300M+ (Varies by source) | Gen Z focus; Strong interest in ACG, Gaming, Tech, Lifestyle | Long/Short Video, Livestreaming, Articles, Comics | Reaching Gen Z, Niche Community Marketing, Brand Storytelling, KOL Collaborations (UPs) | Official Accounts, Content Partnerships, Display Ads, Sparkle Ad Platform (for UPs) |

4.2 Key Digital Marketing Strategies

Success in China requires leveraging strategies that resonate with local consumers and platform dynamics:

- KOL & KOC Marketing: Influencer marketing is deeply ingrained in Chinese consumer culture. Key Opinion Leaders (KOLs), ranging from celebrities to niche experts, offer significant reach and perceived authority [31], [32], [15]. Key Opinion Consumers (KOCs), who are essentially everyday users sharing authentic product experiences, provide crucial relatability and trust, often at a lower cost [31], [63], [15]. A staggering 86% of Chinese consumers report making purchases based on influencer recommendations [32]. Effective strategies often blend KOLs for broad awareness and KOCs for grassroots advocacy and conversion, particularly on platforms like Xiaohongshu, Douyin, and Weibo [31], [32], [63]. Authenticity is increasingly vital as consumers become savvier and regulations tighten [31].

- Livestreaming E-commerce: This is not just a trend but a dominant sales channel. Charismatic hosts (often KOLs or trained brand representatives) showcase products, interact with viewers in real-time, answer questions, offer limited-time deals, and enable immediate purchase within the stream [32], [15], [14], [41]. Platforms like Taobao Live (Alibaba), Douyin, and Kuaishou are leaders in this space [13], [15]. The market's scale is immense, potentially exceeding $1 trillion RMB [14].

- Short Video Marketing: Given the dominance of platforms like Douyin and Kuaishou, short-form video is an essential content format [16], [14], [60]. Brands use engaging, fast-paced videos for storytelling, product demonstrations, tutorials, challenges, and driving traffic to e-commerce channels [14]. High engagement rates compared to traditional formats are often reported [64].

- Private Traffic (私域流量):

Techniques like "fission marketing" (e.g., referral rewards, group buying incentives) are used to grow these private pools [29].This strategy involves intentionally guiding users from public platforms (like Weibo or Douyin ads) into controlled, brand-owned channels, primarily WeChat Official Accounts, WeChat Groups, or dedicated brand apps/mini-programs [29], [30].

The goal is to build a loyal community, foster direct relationships, nurture leads, and reduce long-term reliance on costly advertising and unpredictable platform algorithms [29].

Brands can communicate directly with this audience, offer exclusive content or promotions, gather feedback, and drive repeat purchases with higher conversion rates due to established trust [29]. - Social Commerce: This refers to the seamless fusion of social media experiences and online shopping, allowing users to discover, research, and purchase products without leaving the social platform [60], [41]. Features like WeChat Mini Programs, Douyin Stores, Kuaishou Stores, and shoppable posts on Xiaohongshu exemplify this trend [16], [10], [14].

- Content Marketing & SEO/SEM: Creating high-quality, valuable, and culturally relevant content (articles, guides, videos) remains crucial for attracting organic traffic and building brand authority [34], [35]. Optimizing content for Baidu search (China's leading search engine) and internal search functions within platforms like WeChat and Xiaohongshu is important for discoverability [28]. Baidu PPC (Pay-Per-Click) advertising can drive immediate traffic and leads [60].

4.3 The Role of MarTech

Marketing technology plays a supporting role, although the specific tools popular in China may differ from Western markets. While global platforms like HubSpot CRM are available [61], [62], many brands leverage the built-in functionalities of super apps like WeChat, which offer CRM-like features, customer service automation, and analytics within their ecosystems [16]. AI is increasingly being integrated into MarTech solutions for personalization, predictive analytics, customer service chatbots, and campaign optimization, reflecting broader AI adoption trends in China [44], [59], [60], [41].

The emphasis on "Private Traffic" is a distinctly Chinese strategic adaptation to unique market conditions. Faced with high advertising/KOL costs [31], intense competition [65], [28], algorithm unpredictability, and PIPL complexities [18], [22], brands seek greater control and cost-efficiency.

Private traffic strategies allow building owned audiences in channels like WeChat groups for direct engagement, loyalty nurturing, and effective conversion without continuous platform fees [29], [30]. The super-app infrastructure makes this approach particularly powerful in China, representing a fundamental move towards relationship-driven marketing.

5. Navigating Challenges in China’s Dynamic Marketing Environment

While offering immense opportunities, China's digital marketing landscape presents significant challenges that require careful navigation, strategic planning, and continuous adaptation.

5.1 Intense Competition and Market Complexity

The sheer size and growth potential of the Chinese market attract fierce competition from both established domestic players and ambitious international brands [65], [59], [28].

Standing out requires not only substantial investment but also highly sophisticated and deeply localized marketing strategies that resonate with specific consumer segments [65], [44]. The market's complexity adds another layer of difficulty; China is not a monolith. Marketers must grapple with vast regional diversity, multiple dialects, intricate cultural symbolism, unique shopping festivals (like Singles' Day), and the distinct preferences of different demographic groups (e.g., Gen Z vs. Silver Generation, Tier 1 vs. Lower-Tier city consumers) [13], [28], [60].

Language barriers and cultural misinterpretations pose significant risks, potentially leading to ineffective or even damaging campaigns if localization is not handled with expertise and sensitivity [28].

5.2 Complex Regulatory Landscape

Operating within China's regulatory framework is a critical challenge:

- Data Privacy (PIPL): Complying with the Personal Information Protection Law is a major operational hurdle. It necessitates implementing robust data governance frameworks, obtaining explicit and granular consent for data collection and use (especially for sensitive data and marketing), ensuring data security, managing cross-border data transfers according to strict procedures (which may require government approval), and respecting user rights [18], [23], [21], [22], [59]. This affects targeted advertising, CRM practices, analytics, and the use of third-party data.

- Advertising Laws & Content Censorship: China enforces strict regulations on advertising content, prohibiting false or misleading claims and restricting certain product categories or messaging [12]. Furthermore, the government actively censors online content deemed politically sensitive or socially disruptive (the "Great Firewall"). This requires brands to practice careful content moderation and potentially host websites and data within mainland China to ensure accessibility and compliance [28]. Platform algorithms themselves often incorporate content filtering based on regulatory guidelines [59].

- E-commerce Regulations: Specific rules govern online sales, including consumer protection standards (rights to return, data privacy), prohibitions against unfair competitive practices (e.g., fake reviews), robust intellectual property rights enforcement (addressing counterfeit goods), requirements for product safety certifications, and complex import duties and taxes for cross-border sellers [12]. E-commerce platforms can be held liable for infringements occurring on their sites [12].

5.3 Platform Volatility and Costs

Relying heavily on China's dominant digital platforms introduces risks. Platform algorithms are constantly updated, which can unpredictably affect organic content reach and the effectiveness of paid advertising campaigns [59].

Furthermore, the costs associated with marketing on these platforms can be substantial and are often rising. This includes expenses for paid advertising, increasingly sophisticated ad formats, and fees for collaborating with sought-after KOLs, whose endorsement prices can be very high [6], [31].

Over-dependence on one or two platforms creates vulnerability. Strategies like diversifying platform presence and actively building "private traffic" communities are crucial for mitigating these risks and controlling costs [31], [29], [30].

5.4 Talent Acquisition and Skills Gaps

Finding, attracting, and retaining qualified digital marketing talent in China is a significant challenge for many organizations [47]. There is high demand for professionals who possess the right combination of technical platform expertise, strong analytical skills, creative content capabilities, Mandarin fluency, and deep cultural understanding [20], [57].

This high demand fuels intense competition among employers for top candidates, often driving up salary expectations [47]. Specific shortages may exist in areas like advanced data analytics, CRM, and specialized platform management [20].

5.5 Demonstrating ROI and Managing Expectations

There is immense pressure on marketing teams in China to demonstrate a clear and positive return on investment (ROI), with performance often measured directly against sales growth, profit margins, and conversion rates [44]. This focus can lead to an overemphasis on short-term performance marketing tactics at the expense of long-term brand building, which is crucial for differentiation in a crowded market [44]. Accurately attributing conversions and calculating ROI across complex, multi-platform customer journeys remains a persistent challenge.

Successfully navigating this environment requires a sophisticated approach. Intense competition necessitates differentiation (often via creative branding), yet the ROI focus pushes budgets to performance marketing.

Simultaneously, regulations like PIPL demand rigorous compliance, complicating precise targeting. Therefore, effectiveness demands balancing quantifiable results, strict regulatory adherence, and distinct brand building through deep localization and data-informed, compliant strategies.

6. Future Outlook: Emerging Trends and Opportunities in China Marketing

China's digital marketing landscape is poised for further evolution, driven by technological advancements, shifting consumer behaviors, and deepening integration between online and offline worlds.

6.1 AI Integration Deepens

Artificial Intelligence is set to become even more integral to marketing in China. Its application will extend beyond current uses like chatbots and basic personalization. Expect AI to increasingly power sophisticated content creation, including AI-generated videos and even virtual influencers (AI KOLs) [14], [59], [60].

AI-driven predictive analytics will offer deeper insights into consumer behavior, enabling hyper-personalization at scale across multiple touchpoints [44], [59], [41]. AI will also play a larger role in optimizing campaign performance, media buying, and automating customer service interactions [44], [60].

Furthermore, AI-powered advisors and agents may emerge to help consumers navigate complex choices, simplifying the decision-making process [44].

6.2 Evolution of Social & Immersive Commerce

The fusion of social media and e-commerce will continue its trajectory, becoming an even more deeply embedded part of daily digital life [60], [41]. Livestreaming e-commerce is expected to evolve beyond simple product showcases, incorporating more creative, interactive, and entertaining elements such as gamification, real-time audience voting, and AI-generated personalized recommendations during streams [60].

Looking further ahead, the development of the Metaverse, along with advancements in Virtual Reality (VR) and Augmented Reality (AR), promises new frontiers for immersive commerce. China is expected to be at the forefront of adopting virtual storefronts, 3D product try-ons, interactive virtual shopping events, and commerce within gaming environments [60], [41].

6.3 Cultural Marketing: Guochao and Hyper-Localization

The "Guochao" (国潮) or "National Wave" trend – a surge in popularity for domestic brands and products incorporating traditional Chinese culture, aesthetics, and heritage – shows no signs of waning, particularly among younger generations (Millennials and Gen Z) [60], [54], [55]. This trend reflects growing cultural confidence and a desire for products that resonate with Chinese identity [54], [55].

For marketers (both local and international), this necessitates a move beyond superficial localization towards a deeper, more authentic integration of Chinese cultural elements, values, and narratives into brand messaging and product design [54], [55]. Co-branding initiatives between international labels and popular Chinese brands or cultural IPs can be an effective strategy to tap into this trend [54].

Hyper-localization also means tailoring strategies to the specific values and preferences of distinct consumer segments, such as the environmentally conscious Gen Z, the growing "Silver Generation" with its focus on health and leisure, or the rapidly expanding consumer base in lower-tier cities [13], [60].

6.4 Sustainability and Green Marketing

Environmental consciousness is rising among Chinese consumers, especially younger demographics. This translates into growing demand for sustainable and eco-friendly products, as well as an expectation that brands demonstrate genuine commitment to ethical practices and corporate social responsibility (CSR) [60].

Green marketing and highlighting sustainability initiatives will become increasingly important for brand image and consumer appeal. E-commerce platforms are also responding by prioritizing eco-friendly logistics and carbon-neutral operations [41].

6.5 Omnichannel Integration (O2O)

The distinction between online and offline experiences will continue to blur. Consumers expect seamless transitions and consistent brand experiences whether they are interacting through a mobile app, a social media platform, a website, or a physical store.

This demands sophisticated omnichannel strategies that integrate digital touchpoints (like WeChat Mini Programs used in-store) with offline retail operations (Online-to-Offline or O2O), ensuring fluid customer journeys [20], [9], [54].

The Personalized Authenticity Paradox: The future trajectory points towards mastering this challenge. Leveraging AI for hyper-personalized, efficient experiences is essential [44], [59], [41].

Yet, building genuine trust requires transparency, authentic communication, meaningful community engagement, and deep cultural resonance. Brands using technology to enhance—not replace—authentic connection and cultural relevance will be best positioned for success.

Based on relative emphasis in article Section 6. Scale: 1 (Lower Emphasis) to 5 (Higher Emphasis).

Conclusion: Strategic Imperatives for China’s Digital Marketing Arena

China's digital marketing landscape is characterized by unparalleled scale, rapid innovation, and a unique ecosystem fundamentally distinct from the West. Digital channels, particularly mobile platforms and integrated super apps, dominate consumer attention and advertising spend to an extraordinary degree. Success in this environment is not merely about translating global strategies but requires a deeply localized, nuanced, and agile approach.

Key strategic imperatives for businesses and professionals aiming to thrive in China's digital marketing sector include:

- Embrace Deep Localization and Cultural Fluency: Go beyond surface-level translation to understand and authentically integrate local cultural nuances, consumer attitudes, and trends like Guochao. Mandarin proficiency is often essential.

- Master the Platform Ecosystem: Develop specific expertise in navigating and leveraging China's dominant domestic platforms – WeChat, Douyin, Xiaohongshu, Kuaishou, Weibo, and others.

- Prioritize Regulatory Compliance: Ensure rigorous adherence to China's evolving regulatory framework, particularly the data privacy requirements of PIPL.

- Develop Hybrid Talent: Cultivate professionals blending creative content skills, strong data analytics, platform knowledge, and cross-cultural communication.

- Integrate Social Commerce and Livestreaming: Leverage the fusion of social media and e-commerce, using livestreaming and in-platform purchasing as core sales strategies.

- Build Trust Through Authenticity and Private Traffic: Invest in authentic influencer collaborations (especially KOCs) and build direct customer relationships via Private Traffic strategies (primarily on WeChat).

- Balance Performance with Brand Building: While demonstrating ROI is critical, maintain focus on long-term brand building for differentiation.

- Stay Agile and Embrace Future Trends: Continuously adapt to technological advancements (AI, immersive tech), evolving consumer preferences, and market dynamics.

Navigating China's digital marketing landscape is complex and demanding, but for those who invest in understanding its unique characteristics and commit to localized, compliant, and data-driven strategies, the opportunities for growth and engagement are immense.

Hiring in China?

We can help, and likely lower your hiring costs by over 80%

Our China Candidate Sourcing Service helps companies post & promote open roles across top Chinese jobs & networking platforms.

Let’s find your next great China-based team member together.

Contact us to discuss hiring goals, salary & compensation budgets, and if TeamedUp China is the right fit to support your organization.

New here? Get 25% off your first job post with us.

Our Related Articles

Sources and References

- Horizon Research, "China Artificial Intelligence Market Size & Outlook," 2025.

- State Council of China, "Next Generation Artificial Intelligence Development Plan," July 2017 (updated 2024).

- Ministry of Industry and Information Technology, "Made in China 2025 Strategic Plan," 2015 (revised 2023).

- Bloomberg Technology, "Chinese Tech Giants' AI Infrastructure Investments," February 2025.

- China Academy of Information and Communications Technology, "AI Infrastructure Investment Report," January 2025.

- QS World University Rankings, "AI Research Output by Institution," 2024.

- Goldman Sachs Research, "China's AI Economic Impact Analysis," December 2024.

- DigitalDefynd, "AI Salaries in Asia," March 2025.

- China AI Talent Survey, "China Computer Federation," January 2025.

- Hays Recruitment, "China Technology Salary Guide," 2025.

- Mercer, "Total Rewards in China's Technology Sector," 2024.

- Page Executive, "Highest-Paying Jobs in China," Q1 2025.

- Chengdu High-Tech Zone, "Technology Talent Report," December 2024.

- Xi'an Municipal Government, "AI Industry Development White Paper," October 2024.

- Wuhan East Lake High-tech Development Zone, "Talent Attraction Program Overview," January 2025.

- Roland Berger, "China Tech Cities Report," March 2025.

- South China Morning Post, "AI Talent Retention Strategies," February 2025.

- Nature Machine Intelligence, "International Collaboration in AI Research," January 2025.

- Harvard Business Review, "Dual-Track Career Paths in Technology Firms," March 2025.

- DigitalDefynd, "China AI Talent Report," January 2025.

- China Institute for Employment Research, "Technology Workforce Demographics," 2024.

- Women in AI China Chapter, "Gender Diversity in AI Roles," December 2024.

- LinkedIn China Workforce Report, "Educational Background Analysis," Q1 2025.

- Bureau of Labor Statistics China Branch, "Employment Projections 2023-2033," 2024.

- Shanghai AI Industry Association, "Talent Shortage Analysis," February 2025.

- China Statistical Yearbook on Science and Technology Workforce, "National Bureau of Statistics," 2024.

- China Youth Daily, "Changing Work Culture Preferences," March 2025.

- Randstad Workmonitor China, "Remote Work Adoption in Technology," Q4 2024.

- Harvard Business School, "Knowledge Sharing in Chinese Technology Firms," January 2025.

- MIT Technology Review, "China's AI Data Centers," February 2025.

- Radford Global Technology Survey, "Offer Acceptance Drivers in China," Q4 2024.

- Boston Consulting Group, "Flexible Work and Retention," March 2025.

- Gallup Workplace Analytics, "China Technology Sector Engagement," 2024.

- INSEAD, "Global Mobility in Technology Talent," December 2024.

- China Education Association for International Exchange, "University Recruitment Effectiveness," 2024.

- China Computer Federation, "Technical Community Impact Report," November 2024.

- IEEE Spectrum, "AI Conference Recruitment Analysis," March 2025.

- Zhongguancun Science Park, "Innovation Ecosystem Report," January 2025.

- Cyberspace Administration of China, "PIPL Implementation Guidelines for AI," 2024.

- World Intellectual Property Organization, "China IP Protection in AI," December 2024.

- US-China Business Council, "Technology Transfer Challenges," February 2025.

- Page Executive, "International Companies in China: Success Factors," March 2025.

- IDC China, "Emerging AI Skills Demand," February 2025.

- AI Trends Report, "Chinese Academy of Sciences," January 2025.

- Ethics in AI Lab, "Peking University," March 2025.

- Deloitte China, "Industry-Specific AI Applications," December 2024.

- Semiconductor Industry Association, "China Chip Talent Outlook," January 2025.

- Edge AI and Vision Alliance, "China Market Analysis," February 2025.

- IEEE Transactions on Neural Networks and Learning Systems, "Hardware-Algorithm Co-Design Trends," March 2025.

- Financial Times, "Chinese AI Firms' Global Research Centers," January 2025.

- China Daily, "International AI Talent Exchange Programs," February 2025.

- ISO/IEC JTC 1/SC 42 Artificial Intelligence, "Standards Participation Report," 2024.

- Roland Berger, "China's Generative AI Trends," April 2025.